Bitcoin (BTC) is in the midst of a volatile period as the bulls (unsuccessfully) attempt to reclaim the $70,000 price point.

After suffering a 7% blowout on Tuesday, the BTC/USD pair appeared to be enjoying a rebound in the latter half of the week, but Friday trades have been underwhelming.

At the time of writing, bitcoin was changing hands 2.1% lower at around $67,000, bringing week-on-week performance to -4.4%.

Despite the lacklustre performance, bitcoin ETFs appear to be enjoying consistent cash inflows, with Farside’s ETF tracker showing $106 million worth of inflows yesterday and $113 million on Wednesday.

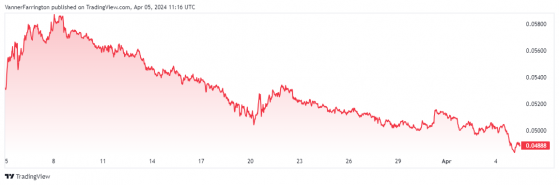

Bitcoin continues to outperform its nearest competitor Ethereum (ETH) though, with the ETH/BTC chart down more than 12% month on month.

This suggests either a lack of appetite for riskier altcoins, or a lack of fundamental catalysts to move the ether dial.

Though ETF issuers have been piling pressure on the US Securities and Exchange Commission to approve ether ETFs after January’s approval of bitcoin ETF, no evident progress has been made.

The ETH/BTC pair has dipped 12.4% month on month – Source: tradingview.com

In the broader altcoin space, Ripple Labs’ shock announcement that it is entering the stablecoin market has failed to do much for its flagship XRP token, which remains 8% lower week on week.

BNB, Solana (SOL), Dogecoin (DOGE) and Cardano (ADA) are all on the red too.

Global cryptocurrency market capitalisation currently stands at $2.5 trillion, with bitcoin dominance at 52.9%.

Read more on Proactive Investors AU