Following an extensive break from the public eye, a sense of excitement has returned to bitcoin (BTC).

Since the start of 2023, the standard bearer of the cryptocurrency markets has outstripped all other major asset classes by posting a 120% year-to-date gain on the BTC/USDT pair.

As such, browbeaten bitcoin bulls have returned to shouting from the rooftops of $100,000 price targets and a complete overhaul of the global financial system.

The potential catalysts are aplenty for bitcoin in the coming months, though that doesn’t mean all will crystallise.

Regardless, what is making the market all giddy, and what should investors be keeping an eye on in the months ahead?

Catalyst One: Bitcoin halving

Mining rewards will halve for the fourth time in April 2024 after the 740,000th block is mined.

Post halving, each block will reward miners with 3.125 BTC compared to 6.25 BTC today.

Supply-and-demand economics stipulate that fewer bitcoins entering the market increases the scarcity of the circulating bitcoins.

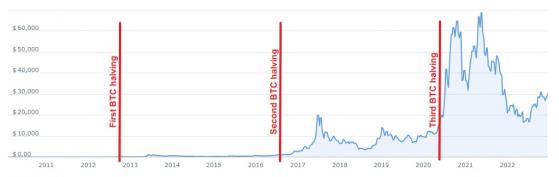

The internet is awash with graphs proving just how great each bitcoin halving has been for the price (like the one below courtesy of Finbold, for instance), though mankind’s propensity for finding rhythm in the madness of markets shouldn’t be ignored.

Has bitcoin reached new all-time highs (ATH) following each halving? Undoubtedly, but as we all know, correlation doth not imply causation, and the periods between each halving and subsequent ATH vary wildly.

Sceptics will also point to the Litecoin (LTC) halving in August this year, which failed to spur any sort of a bull run on the LTC/USDT pair.

Catalyst Two: Bitcoin ETFs

It is becoming increasingly likely that we will see spot bitcoin exchange-traded funds (ETFs) enter the US market sooner rather than later, especially after BlackRock (NYSE:BLK) threw its hat in the ring.

Market participants have been laser-focused on the developments in this space, and news coverage has been extensive to put it lightly.

For a quick recap, Grayscale has been pleading with the US regulators for years for permission to convert its heavily discounted Grayscale Bitcoin Trust (GBTC) into a stock market-traded ETF product.

The US Securities and Exchange Commission (SEC) had paid it and similar applications no mind, until BlackRock brought the full force of the world’s largest asset manager into the equation.

To get an idea of how much this prospect excited the bulls, the BTC/USDT rallied nearly 25% in the week following BlackRock’s ETF filing, all because of mere hype and speculation.

Bitcoin was already having a good year in comparison to the disaster that was 2022, but this injection of hope changed the game completely.

As of today, the world’s largest cryptocurrency is over 120% higher since the start of the year.

If that sounds to you like the market has already priced in these approvals, you’re not alone.

In Matteo Greco, research analyst at Fineqia’s opinion, the market has already priced these expectations in. Furthermore, the downside risk of a rejection is greater than the upside risk of an approval, according to Greco.

He said: “Of course, an approval would have a positive uptrend immediately… but I am pretty convinced a rejection would have a bigger impact on the downside, in the short term at least.”

The SEC has a 10 January deadline to grant approval for 21Shares’ ETF application, when the regulator is expected to either grant sweeping approvals or sweeping rejections of all applications on the table.

Catalyst Three: Macroeconomic pivot

Bitcoin was born out of the 2008 financial crisis. This means bitcoin is currently facing one thing it has never had to face in its 15-year lifetime: soaring interest rates.

As central banks across the world have reined in fiscal policy to get a grip on inflation, so too have the risk-on markets been reined in.

Now that interest rates have likely peaked as inflation has cooled off, there is little to no prior data to suggest how bitcoin might react.

There is every chance that, as investors start withdrawing from the bond markets as fixed-income rates fall off, some of this money is likely to find its way into the crypto markets.

When that might be though, is a matter of speculation, with a ‘higher-for-longer’ interest rate narrative starting to take hold.

A cooling off of monetary policy could also result in a cooling of the US dollar; a bullish prospect for the BTC/USD pair.

Catalyst Four: Technical indicators

Technical analysis is great in that trend lines and signals can be drawn and manipulated to fit any narrative you want. Astrology for markets, as they say.

Regardless, trend lines point to both a short-term and mid-term upswing in bitcoin’s price.

The orange line on the graph below represents bitcoin’s average closing price over the past 200 days, while the green line represents bitcoin’s average closing price over the past.

Both are moving higher, indicating bullishness in both the short and mid-term bitcoin spot price.

Credit: Binance.com

A ‘golden cross’ occurs when the 50-day moving average (MA) crosses above the 200-day MA. This supposedly indicates an emerging bull run, though once again, the propensity for finding methods in market madness cannot be ignored.

Both of the 2021 bull runs came after a golden cross, as did the March rally earlier this year, though at vastly different intervals.

The momentum indicators are less bullish, with the relative strength index (RSI) showing a recent overbought period which could mean bitcoin’s currently elevated price is running out of steam.

What does this all mean?

For every bullish catalyst, there is at least one sceptical take on the matter. Can bitcoin reach $100,000?

It is certainly possible, but we all know by now that the cryptocurrency markets are impossible to predict.

Just like any other field of investing, it pays to do your own research and plot your own course.

Read more on Proactive Investors AU