Cryptocurrency investment vehicles dealing in bitcoin and ether saw a marked increase in outflows in the last week, according to data compiled by CoinShares.

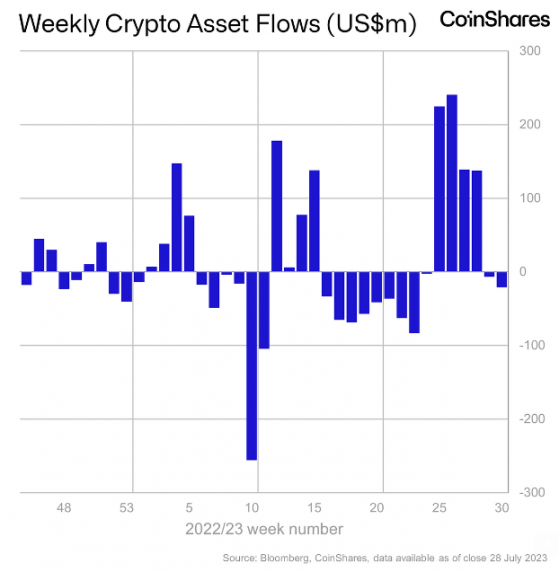

In the seven days up to Friday, July 28, digital asset investment products as a whole saw around US$20.9mln (£16.3mln) in outflows, up from US$6.5mln of outflows the week before.

Bitcoin investment products accounted for 93% of outflows at US$19.4mln, while ether investment products saw outflow worth US$1.9mln.

Despite a prolonged altcoin off-season, Solana (SOL), Ripple (XRP) and Cardano (ADA) saw minor inflows, albeit all at less that US$1mln per asset class.

This is in stark contrast to major inflows cross the whole market seen in early July, when major bitcoin and other cryptoasset investment vehicles run by CoinShares, 21Shares, ProShares topped inflows of US$200mln.

At this point, the price of bitcoin was trending comfortably above US$30,000, but the benchmark cryptocurrency has failed to sustain this price point in more recent weeks.

At the time of writing, the BTC/USDT pair was swapping for US$29,400.

Credit: Bloomberg/CoinShares

On the upside was the US$3.1mln in outflows from short-bitcoin investment products, which are used to bet against the price of the world’s largest cryptocurrency.

“This suggests investors have been taking profits in recent weeks, with the sentiment for the asset overall remaining supportive,” said CoinShares.

Read more on Proactive Investors AU