Ethereum is having its time in the spotlight amid a groundswell of optimism for ether-backed exchange-traded funds in the UK and US.

According to large-cap ETF sponsor WisdomTree, it has received the thumbs up from the UK Financial Conduct Authority (FCA) to list both bitcoin and ether exchange-traded products (ETPs are the European equivalent to ETFs) on the London Stock Exchange.

WisdomTree called it “a significant step forward for the industry and UK-based professional investors seeking exposure to the asset class”.

“While UK-based professional investors have been able to allocate to crypto ETPs via overseas exchanges, they will soon have a more convenient access point.

“FCA approval in this respect could result in greater institutional adoption of the asset class, as many professional investors have been unable to gain exposure to bitcoin and other cryptocurrencies due to regulatory limitations and uncertainty – we would expect FCA approval of our crypto ETPs’ prospectus to remove those barriers to entry.”

It marks a surprising turn of events for the UK cryptocurrency sector, which has lagged behind the US in bringing cryptocurrency ETFs into the traditional markets.

The US Securities and Exchange Commission (SEC) approved bitcoin ETFs back in January, but the FCA has seemingly beaten its stateside counterpart to the ether punch.

It may only be brief- this Thursday and Friday, the SEC is set to decide on ether-backed ETFs from VanEck and Ark Invest.

Analysts were roundly dismissive of the prospect of these approvals, but the tone has changed in recent days and Bloomberg has upped the likelihood from 25% to 75%.

There is one wrinkle in the FCA’s recent about-face on crypto ETPs- only institutional-grade investors are privy to them, leaving retail investors in the dark for the time being.

“The FCA continues to believe cETNs and crypto derivatives are ill-suited for retail consumers due to the harm they pose,” the FCA said in March. “As a result, the ban on the sale of cETNs (and crypto derivatives) to retail consumers remains in place.”

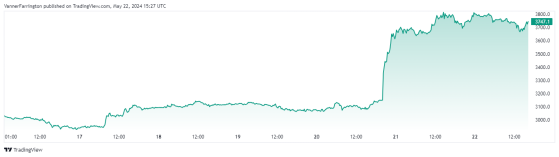

With ETF hype mounting, ether has shot up 25% against the US dollar over the past seven days.

ETH/USD’s week-on-week rally – Source: tradingview.com

The pair briefly hit a 10-week high of $3,841 on Tuesday before falling back a bit this morning to trade at $3,743 at the time of writing.

Bitcoin, in contrast, is up 8% against the US dollar as was swapping for $70,100 at last count.

Global cryptocurrency market capitalisation currently stands at $2,59 trillion, with bitcoin dominance at 53.3%.

Read more on Proactive Investors AU