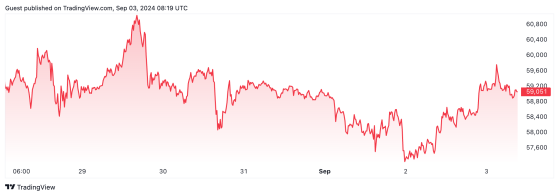

Bitcoin bounced off a two-week low to stage a 3.2% recovery that brought the benchmark cryptocurrency above $59,100 on Monday.

Early Tuesday exchanges have been muted, with the BTC/USD pair staying flat at $59,050 at the time of writing.

Analysts at Bitwise (formerly ETC Group) said there is a “consolidation phase” underway in what is traditionally the world month for bitcoin.

“Overall crypto sentiment has turned bearish again,” they said. “It is quite likely that September will see continuing consolidation until Q4 as September has historically been the worst month for Bitcoin’s performance from a pure seasonality perspective.

“On a positive note, we think that the bearish crypto sentiment makes further downside risks less likely in the short term and, thus, we also do not expect that the market will revisit the lows from early August.”

Bitwise also highlighted declining intraday buying volumes and exchange-traded fund outflows, which are adding to the bearish sentiment.

On the plus side, bitcoin’s illiquid supply has reached a new all-time high of almost 74% of circulating supply.

This suggests a greater propensity among whales to ‘HODL’ bitcoin, which is a bullish indicator.

As it stands, bitcoin is around 9% lower week on week and 40% higher year to date.

Bitcoin dips – Source: tradingview.com

Read more on Proactive Investors AU