Bitcoin (BTC) added 1.7% against the US dollar on Thursday morning after closing lower yesterday, bringing its week-on-week performance above 4%.

Bitcoin exchange-traded funds continued to recover on Wednesday, with another $243 million of cash inflows, adding to the $400 million plus earlier in the week.

The bitcoin ETF space as a whole is approaching $12 billion of net cash inflows for the first time since the US Securities and Exchange Commission approved the products in January.

Last week, interest in the ETF space appeared to be cooling off, but the recent rebound suggests the market remains resilient for now.

This has been helped by the introduction of an 11th bitcoin ETF to the scene- Tidal Investments’ and Hashdex Asset Management’s ‘Hashdex Bitcoin ETF’, trading under the DEFI ticker.

Hashdex serves as the digital asset advisor for DEFI, with Tidal serving as DEFI’s sponsor. DEFI was previously trading as a futures ETF.

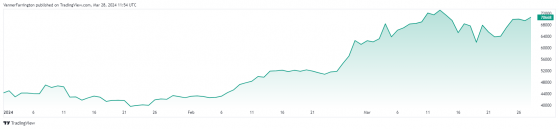

Bitcoin is up 67% year to date – Source: tradingview.com

Over to the altcoin space, Ethereum (ETH) closed 2.4% lower against the US dollar yesterday before surging 2.4% higher this morning.

The ETH/USD pair is currently swapping for $3,581, marking a slight week-on-week increase.

Dogecoin (DOGE) remains the top altcoin dog at the moment; the meme coin is currently 46% higher against the US dollar.

Fellow meme coin Shiba Inu (SHIB) is up around 20%.

Global cryptocurrency market capitalisation currently stands at $2.66 trillion, with bitcoin dominance at 52.3%.

Read more on Proactive Investors AU