There was barely a dull moment in the cryptocurrency markets this week, what with the industry’s last remaining figurehead falling from grace, Kraken facing yet another legal challenge from the regulators and Bitcoin prices experiencing some wild mood swings.

The tumultuous session kicked off with Changpeng ‘CZ’ Zhao stepping down as head of Binance, the world’s largest cryptocurrency exchange that was founded six years ago.

CZ rescinded his role as part of a $4.3 billion settlement with US regulators over money laundering, bank fraud and sanctions violations charges.

It is unclear what fate has in store for CZ from here on in, but in the near term, Binance is seeing significant outflows, with largest rival Coinbase Global Inc (NASDAQ:COIN) swooping in and cleaning up.

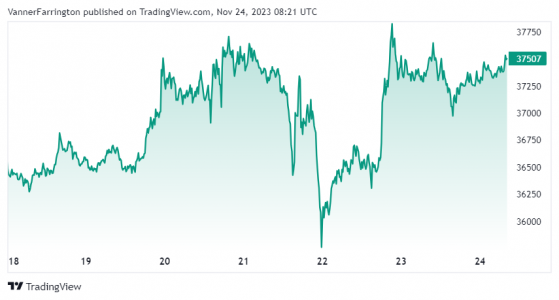

Bitcoin initially nosedived in the midst of this upheaval, plummeting more than 4.5% against the US dollar on Tuesday.

However, in a sign of resilience, the benchmark cryptocurrency clawed back all of these losses merely one day later, while the rest of the week was relatively calm.

A the time of writing, the BTC/USDT pair was trading above $37,500, or nearly 4% higher on a week-on-week basis.

Bitcoin shows resilience to market turmoil – Source: tradingview.com

Binance’s native BNB token plummeted more than 10% on the day of CZ’s departure, and while there has been some recovery, it has shown significantly less resilience than bitcoin, remaining 4% lower week on week.

The second-largest cryptocurrency Ethereum (ETH) surged in the latter half of the week and has managed to add more than 5% since last Friday. At the time of writing, the ETH/USDT pair was swapping for $2,083.

Across the wider altcoin space, Ripple (XRP), Cardano (ADA), Toncoin (TON) and Chainlink (CHAIN) are in the green, while Solana (SOL), Dogecoin (DOGE) and Tron (TRX) are out of favour with traders.

Global cryptocurrency market capitalisation currently stands at $1.43 trillion, with bitcoin dominance above 52.5%.

Read more on Proactive Investors AU