Analysts are calling the latest round of mega tech earnings a win, and share prices have supported the thesis.

Facebook-owner Meta surged 12% in post-market trades after beating active user expectations, while Microsoft (NASDAQ:MSFT) closed 7% higher after delivering “masterpiece” results in the cloud segment.

Google parent Alphabet (NASDAQ:GOOGL) was an outlier; though earnings weren’t necessarily bad, shares didn’t see a rally in line with its Big Tech brethren.

While the correlative history of Big Tech stocks and bitcoin is a contentious one, the world’s benchmark cryptocurrency was undoubtedly boosted by this latest round of positive results, but it wasn’t smooth sailing.

Wednesday’s trading session was incredibly choppy – close to 10% in amplitude between intraday lows and highs.

That choppiness was caused by fears that large sums of bitcoin were poised to be dumped onto the market from accounts linked to the Mt Gox exchange that collapsed in 2015.

The vast sums of bitcoin locked up in the Mt Gox bankruptcy have been a bugbear for the market in recent years, with fears that a large-scale sell-off could tank the price of bitcoin.

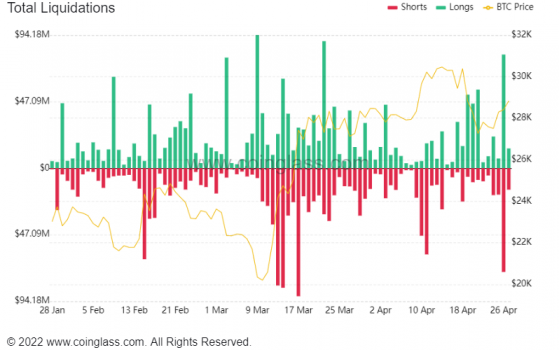

These fears caused bitcoin to shoot 7% lower, causing a massive surge in long-bitcoin liquidations.

Bitcoin longs and shorts get a pummeling – Source: coinglass.com

But the market pulled its wits together and BTC/USDT closed over US$28,400, while the pair was seen 1.2% higher at US$28,770 after this morning’s Asia trading session.

Not momentous moves by any stretch, but enough to keep bitcoin above the 27k-28k range that may have proved a likely contraction point in the recent market correction.

A depressed US Dollar Index (DXY) is also providing some tailwind for bitcoin of late.

Once again, 30k is in the bulls’ firing line, with significant selling pressure amassing at this psychological price point, going by the Binance order book.

Bitcoin (BTC) back to 30k? – Source: currency.com

Ethereum (ETH) saw an equally choppy Wednesday session, with 9.6% in amplitude between lows and highs before closing flat at US$1,870.

ETH/USDT crept 0.8% higher in this morning’s Asia trading session, bringing the pair above US$1,880. Binance’s order book shows resistance at the US$1,930 price point.

Ethereum futures contracts also had a field day, racking up US$34.4mln in long liquidations and US$26.5mln in short liquidations.

Global cryptocurrency market capitalisation currently stands at US$1.19tn after adding 0.8% overnight, while total value locked in the decentralised finance (DeFi) space added 0.6% to US$49.2bn overnight.

Read more on Proactive Investors AU