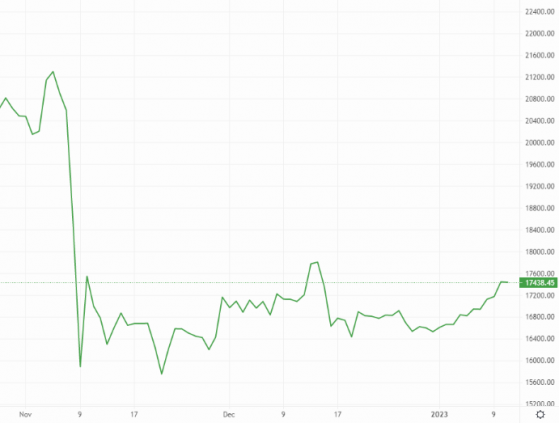

Bitcoin (BTC) ended up adding 1.5% on Tuesday, the biggest daily gain since December 20, 2022.

Volumes saw a market increase which allowed the benchmark cryptocurrency to touch US$17,500 before the sellers stepped in, but having closed above US$17,400, it was still an encouraging trading session for the BTC/USDT pair.

Investors were failing to achieve either upside or downside in Wednesday's opening hours, with the pair’s price remaining essentially flat.

BTC bulls will be targeting US$17,550 as the next breakthrough price, while a bear advantage could see BTC/USDT fall back to US$17,300.

Bitcoin (BTC) fights to claw back post-FTX losses – Source: currency.com

Ethereum (ETH) added a little over 1% yesterday to close above US$1,330, a price point that has been sustained at the time of writing.

The ETH/USDT pair could hit US$1,350 should a bearish advantage come to the fore.

Grayscale Bitcoin Trust's (GBTC) woes have been tempered slightly amid a generally positive trading environment. Having traded at a near 50% discount in recent months, the world’s largest bitcoin investment vehicle has closed the gap to below 40%.

In the altcoin space, Cardano (ADA) and Solana (SOL) remain the strongest performers among the large caps, although Binance’s BNB token is also outpacing the market, having added around 9% week-on-week.

Gala Games’ GALA token took a sharp 6.5% reversal today, following its dramatic doubling in value over the past week after announcing the acquisition of Gala Entertainment.

Global market capitalisation across all cryptocurrencies is currently at US$857bn, while total volumes locked across all decentralised finance (DeFi) protocols is US$41.2bn.

Read more on Proactive Investors AU