The crypto markets inched higher on Tuesday morning, with 1.5% added to the now-US$938bn market capitalisation.

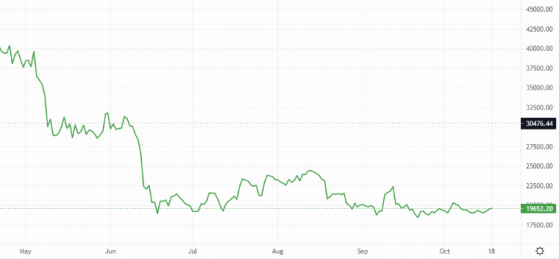

Bitcoin continued its historically low volatility streak with a small gain to US$19,600, roughly the same price point month-on-month.

Ethereum similarly edged upwards to US$1,300, having stayed within the same trading range across the four-week period.

Bitcoin’s sideways trade continues to consolidate – Source: currency.com

There was little price action in the large-cap altcoin space, barring Polygon (MATIC), which jumped over 8%, bringing its market cap up to US$7.6bn.

Solana (SOL) slightly outperformed the market with a 2.7% increase across the 24-hour period.

The decentralised finance (DeFi) space, which has been on something of a rally recently, again held the top movers, particularly the decentralised stablecoin exchange Curve, which rallied over 9% to US$480mln.

MakerDAO and Lido DAO were also among the day’s top performers.

After suffering a slight dip on Monday, the Huobi Global exchange’s HT token continued its upward trajectory following the recent acquisition by About Capital Management.

With a market cap just below US$1.2bn, HT is 45% up week on week.

The US$2.4bn Quant (QNT) blockchain was the morning’s worst performer, having dipped 9%, while iFinex’s LEO token, Casper (CSPR), and Compound Finance (COMP) also moved in a negative direction.

Read more on Proactive Investors AU