Bitcoin’s price remains heavily discounted as FTX headwinds continue to bite.

Changing hards at US$16,800, the benchmark cryptocurrency has managed to add 2% in today’s session, though indecision among investors continues.

With traditional equities indexes on the way up, traders may be drawn away from a crypto market battling with a string of crises.

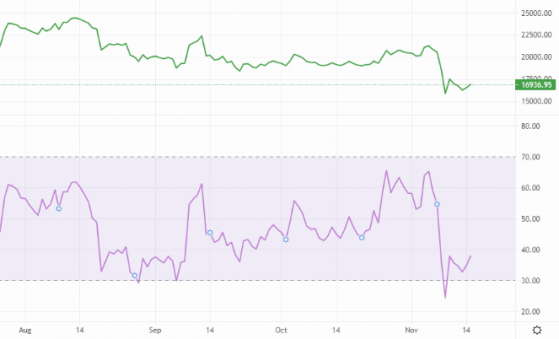

But with a support line drawn at US$16,000 and relative strength suggesting an oversold position, a potential buy-in could be on the horizon which should drive bitcoin’s price forward.

BTC’s relative strength index shows oversold position. Will bulls buy in? – Source: currency.com

Ethereum (ETH) is battling the same headwinds, with price action centred around the US$1,270 point.

ETH’s fist hurdle will be breaking above the US$1,280 to US$1,290 range, where resistance is ostensibly mounted.

In the altcoin space, Trust Wallet Token (TWT) continues to surge following a ringing endorsement from Binance head Changpend ‘CZ’ Zhao.

TWT’s market capitalisation has doubled in the past week and continues to look strong at close to US$1bn, though a correction will undoubtedly kick into gear once sentiment cools down a bit.

Ripple (XRP) is also looking strong. Close to 10% added in the past 24 hours due to the long-running dispute with the US Securities and Exchange is looking promising for developer Ripple Labs.

While all large-cap altcoins remain significantly down week on week, Cardano (ADA), Polkadot (DOT) and even the battered Solana (SOL) token managed to inch higher in this morning’s session, raising hopes for a gradual recovery.

Polygon (MATIC) seems to be the one outlier, with the Layer-2 protocol shaving a percentage point off of its US$8.2bn market cap.

Cronos (CRO), the native token of centralised exchange Crypto.com, has rebounded 10%, despite largely unfounded speculation circling regarding the company’s solvency.

Global crypto market cap currently stands at US$850bn, with US$43.6bn in total value locked across all decentralised finance (DeFi) protocols.

Read more on Proactive Investors AU