Bitcoin and the wider cryptocurrency markets remain a low-spirited affair as the week gets underway.

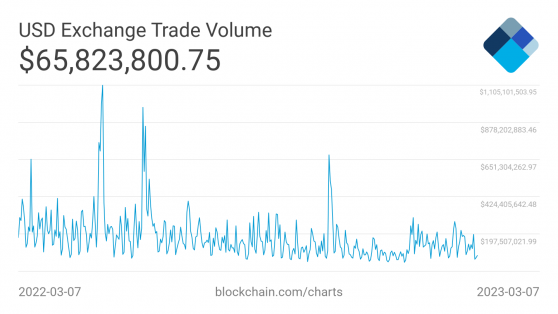

We can see from the chart below that exchange-traded bitcoin volumes are particularly low compared to the trailing 12 months. Though this doesn’t account for over-the-counter exchanges, it still indicates a comparatively low interest among traders right now.

Bitcoin interest could be feeling the effects of negative press, whether that’s aggressive action taken by the regulators into the broader cryptocurrency space, or the crisis surrounding high-profile crypto bank Silvergate Capital.

The White House press secretary Karine Jean-Pierre told journalists on Monday the government is monitoring the Silvergate situation

As Silvergate tanks even further, Microstrategy, Coinbase (NASDAQ:COIN) and others jump ship

Dollar strength is also an unavoidable headwind. Despite the disinflation narrative circling around the start of the year, the US Dollar Index (DXY) added over 2% in February alone and despite some small clawback since, there’s reason to believe greenback strength will persist.

As ING analysts this morning said: “While welcoming the start of a broad disinflation process in early February, we doubt Powell will push back much against expectations of another 75bp of Fed(eral reserve) hikes. This should see the dollar hold gains.”

Put together, the market environment doesn’t exactly scream bullish on bitcoin, nor should it spark fear in the hearts of the bulls.

For now, the BTC/USDT pair is changing hands at US$22,400, essentially the same price point for the past four days, with some buyers’ support parked at US$22,200 per the Binance order book.

Is bitcoin (BTC) stuck in a rut? – Source: currency.com

As for Ethereum (ETH), the second largest cryptocurrency has closed inside the US$1,560 and US$1,570 band for the past three days and is currently in the range as of Tuesday morning.

In the altcoin space

Following weeks of extended losses, Polygon (MATIC) appears to be reversing its fortunes. The Layer-2 blockchain added over 3% on Tuesday morning, safely outperforming the market.

MATIC investors are gearing up for the much-hyped zkEVM Mainnet Beta, slated for launch at the end of the month.

Avalanche (AVAX) had a good Monday session, closing 2.5% higher but has levelled out this morning, in line with the rest of the top-20 set.

Shiba Inu-themed meme coin FLOKI entered the top-100 club following a 9% overnight rally which brought the Ethereum and BNB Chain-based token’s market capitalisation up to US$393mln.

FLOKI appeared to rally on the back of a listing with major Indian cryptocurrency exchange WazirX.

Other top movers included gaming platform Enjin Coin (ENJ), decentralised exchange GMX, and decentralised staking platform ssv.network (SSV).

Global cryptocurrency market cap added 0.4% to US$1.03tn overnight, while total value locked across all decentralised finance (DeFi) protocols remained an even US$48.3bn.

Read more on Proactive Investors AU