Aussie copper and iron ore giant BHP (ASX:BHP) sent ripples through the mining sector after approaching Anglo American (JO:AGLJ) with a £31.1 billion bid for its smaller London-listed rival.

Under the “unsolicited, non-binding and highly conditional combination proposal”, as Anglo called it, BHP wants Anglo to spin out key subsidiaries Amplats and Kumba

This makes sense, in investment bank Jefferies’ view; Amplats (Anglo American Platinum) and Kumba Iron Ore are both based in South Africa and listed on the Joburg bourse but “BHP does not want exposure to South Africa”.

At least, that’s what Jefferies’ analysts presume, citing South Africa’s labour issues, geological challenges and power constraints.

In line with that thinking, BHP, in its takeover proposal, indicated that Anglo’s diamond business De Beers, which has mining operations in Botswana, Namibia and South Africa, would be “subject to a strategic review post completion”.

A Wall Street Journal exclusive suggested that spinning off De Beers is on the cards for Anglo, takeover or no takeover.

Natural diamond prices collapsed in the past year and while De Beers reported a recovery in the second cycle of the current year, lab-grown alternatives and sluggish Chinese demand remain existential risks for the diamond market.

It has previously been reported that Ango wanted to write down the carrying value of De Beers amid this protracted slump in diamond prices.

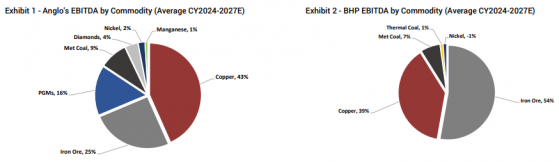

Effectively, BHP is really just interested in Anglo’s copper operations, which comprise around 43% of Anglo’s earnings.

Iron Ore produced by subsidiary Kumba comprises a quarter of Anglo’s earnings, but its South African domiciliation is apparently too much trouble than it’s worth.

The copper synergies between the two entities are clear, as detailed in the below pie charts of the companies’ earnings mixes (Source: Jefferies).

However, this could give rise to antitrust risk, Jefferies warned. Nonetheless “there is a strategic rationale to this approach and structure”, said the investment bank.

Jefferies stated: “Anglo would be a good strategic fit for BHP or another major miner due to potential synergies, asset quality, and commodity exposure (especially copper).

“Our analysis indicates that Anglo consists of an undervalued portfolio of multiple tier-1

assets, several of which are in relatively low-risk jurisdictions (Chile, Peru, Australia, Brazil).

“There is a scarcity value to tier-1 mining assets that is not reflected in equity valuations. Hence, Anglo could be a compelling fit at the right price.”

BHP’s initial offer puts a 2,508p per share valuation on Anglo, while Jefferies suggests a higher valuation of 2,824p.

South Africa’s minerals resources minister Gwede Mantashe has now come out as a vocal opponent of BHP’s attempted takeover.

Anglo American was founded in Johannesburg in 1917 and retains a secondary listing on the Johannesburg Stock Exchange.

Matashe said the country’s previous interactions with BHP were “not positive” after the Aussies merged with South African miner Billiton in 2001.

“What we saw is that it dumped coal and then created a small company called South32, which is now marginal,” Mantashe told the Financial Times. It is unclear how much this could affect the deal, but it could prove a headache nonetheless.

Under UK takeover rules, BHP has until 22 May to put up a formal offer or shut up.

“If BHP does indeed continue to pursue this deal, we would be surprised if other bidders do not emerge. It is of course also possible that BHP walks away if Anglo is unwilling to engage. Let the games begin,” said Jefferies.

Read more on Proactive Investors AU