Bellevue Gold Ltd (ASX:BGL) has launched a fully underwritten institutional placement of shares to raise A$60 million and a non-underwritten share purchase plan (SPP) to raise up to A$10 million.

In conjunction with existing cash on hand, proceeds from the offer will be used to accelerate underground development and exploration at the Bellevue Gold Project in Western Australia, further de-risking the production outlook and increasing financial flexibility during construction and ramp-up.

Bellevue’s accelerated development strategy will allow the company to:

- Accelerate 4,000m – 5,000m of underground development to open additional production fronts and de-risk post-production run-rate, and reduce development costs during ramp-up;

- fast-track the independent Tribune mining front earlier than scheduled and leverage on-site open pit mining equipment for construction of the portal development;

- fund additional grade control drilling to improve geological confidence and continue to build on the success to date in identifying meaningful upside to May 2022 mineral resource;

- fund additional exploration step out and resource definition drilling targeting growth of the project resource and reserve inventory; and

- provide additional balance sheet flexibility to commercial production, in conjunction with the existing A$200 million undrawn Macquarie Project Finance Facility and cash at bank of A$47 million as at 30 November 2022 (unaudited).

“Opportunity to unlock the value of the project sooner”

Bellevue managing director Steve Parsons said: “Every aspect of the project is going to plan or better.

“Development rates, grade control drilling results and exploration are all exceeding our expectations.

“The success is providing us with an opportunity to unlock the value of the project sooner and to a greater extent than originally planned.

“This additional funding will enable us to capitalise on this opportunity by bringing forward some of the underground development, de-risking the production outlook in the process.

“It will also ensure we have a robust level of working capital as we ramp up production”.

Details of placement and SPP

New shares under the A$60 million placement will be issued at A$1.05 per share, representing a 13.2% discount to the last closing price of A$1.21 on Monday, 5 December 2022.

The placement is fully underwritten by Macquarie Capital (Australia) Limited and Canaccord Genuity (TSX:CF, LSE:CF) (Australia) Limited.

Following completion of the placement, Bellevue will offer all eligible shareholders in Australia and New Zealand the opportunity to participate in the non-underwritten SPP of up to A$10 million.

Under the SPP, new shares will be offered at A$1.05, being the same offer price as the placement.

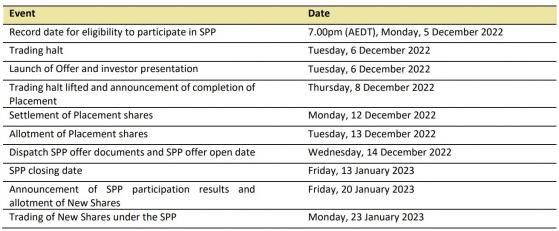

The record date for the SPP is 7.00pm (AEDT) on Monday, 5 December 2022.

Timetable

Bellevue Gold Project update

The delivery schedule for the Bellevue Gold Project remains on track with first production targeted in the second half of CY2023 and ramp-up expected to take two months post first production.

In particular:

- Construction is well advanced with GR Engineering Ltd fully mobilised and advancing construction activities with bulk earthworks completed;

- mining development is ahead of schedule with the Develop Global Ltd (ASX:DVP) mining fleet updated with new equipment landed on site, a second jumbo commenced in October 2022, a third to commence in January 2023 and a fourth expected to commence in April 2023. Since June 2022, Bellevue has achieved a 32% uplift on underground development rates vs planned development; and

- approvals and permitting remain on track with current development timetable. The key approvals for the construction of the processing plant were secured in October/November 2022 and construction of the plant is now underway.

Bellevue expects that the remaining pre-commercial production project costs is ~A$219 million, after incorporating additional accelerated underground development capital, with remaining expenditure significantly derisked as a result of 90% of the pre-production capital being contracted.

The remaining material contract is for open pit mining, which is at an advanced tender stage and is expected to be awarded in the coming weeks.