Base metals play an important part in the clean energy race, with commodities like nickel and copper taking centre stage in battery and energy technologies.

But where is the market expected to head in the final months of FY23, and how have ASX-listers moved on their base metal vision in the last quarter?

Give me the elevator pitch

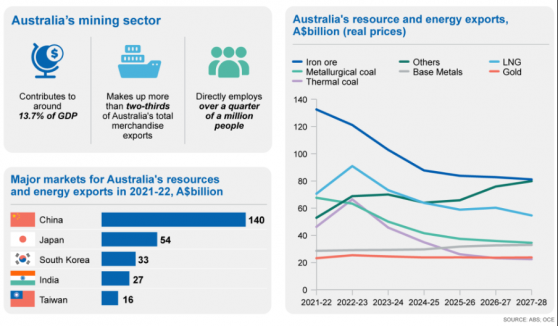

With the move to renewable energy sources front of mind, the Australian Government’s Resources and Energy Quarterly expects lithium and base metal products to earn around $47 billion in the current financial year.

“Base metals and critical minerals such as lithium are crucial components of clean energy technologies such as batteries, solar panels and wind turbines, which will help the world lower emissions and meet net-zero commitments,” Resources and Northern Australia minister Madeleine King said.

Exports are on the up, too — the quarterly forecasts that outflows for lithium and base metals, as well as their raw materials, will match coal export values by 2028.

Snapshot of the Australian resource sector in the 2023 March quarter.

However, those export earnings are forecast to ease to $395 billion in 2023–24 and $346 billion in 2024–25 as prices continue to normalise.

According to the report, that’s because markets have priced in weaker world economic growth and the loss of some Russian resource and energy commodity output in 2023.

“Should inflation prove harder to tame, central banks may have to hold monetary policy tighter — and for longer — risking slower-than-expected growth and thus lower commodity demand,” it explained.

While growth may slow, the trends don’t undermine the rising need for ethically sourced, high-grade base metals.

If Australian companies play their cards right, they’re first in line to mine the resources that will drive our future energy sources.

In the spotlight: ASX base metal stocks

Australian Gold and Copper

Australian Gold and Copper Ltd (ASX:AGC) used the first few months of 2023 to focus on precious and base metal prospectivity at its South Cobar Project, situated in the famed NSW mining district of the same name.

During the quarter, the explorer kicked off an induced polarisation (IP) survey program, designed to chase up large-scale prospective trends on the South Cobar property.

The first of three high-impact surveys focused on the Achilles prospect, infilled to 200 metres over 26.4 line kilometres as the company hunted for sulphide mineralisation.

That survey recently produced a suite of priority drill targets, revealing two large chargeability zones that strengthen considerably with depth.

Post quarter-end, AGC kicked off surveillance at the Hilltop target, with more work to follow at the Planet prospect as the company progresses the hunt for Cobar-style copper, gold, zinc and lead.

Helix Resources

Helix Resources Ltd (ASX:HLX) managing director Mike Rosenstreich said his company went from “strength to strength” in recent months, delivering high-grade assays from its aggressive drilling campaign at the Canbelego Main Lode in NSW.

The jewel in this quarter’s crown was a highly conductive target — interpreted as a high-grade copper shoot — that appeared roughly 200 metres down plunge from other drill intercepts in the Lower Canbelego Main Lode.

Meanwhile, reverse circulation (RC) drilling encountered a shallow, high-grade copper zone at the Upper Canbelego Main Lode, where the best results include:

- 25 metres at 1.87% copper from 13 metres, including 5 metres at 5.35% from 18 metres; and

- 10 metres at 3.02% from 100 metres, including 6 metres at 4.72% from 103 metres.

In other news, Helix established Ionick Metals Ltd as a special purpose vehicle help fund its nickel-cobalt assets in the Greater Cobar region.

The move could lead to a spin-out or a strategic partner-type investment as Helix siphons its ex-copper interests into a dedicated exploration venture.

QMines

QMines Ltd (ASX:QML) says that a pit optimisation study — based on the Mt Chalmers Copper Project's fourth mineral resource — built confidence in a prospective mining model during the March quarter.

In anutshell, the study outlined a scenario that weighed in at 7.1 million tonnes at 1.5% copper equivalent for 94,300 tonnes of metal.

Mt Chalmers pit optimisation schematic.

As a result, additional metallurgical test work is now underway to advance Mt Chalmers into feasibility work and deliver a maiden ore reserve.

On the exploration front, QMines received assays for the final six Mt Chalmers drill holes, with highlights including:

- 12 metres at 3.03% copper equivalent from 158 metres;

- 14 metres at 0.75% from 83 metres; and

- 3 metres at 0.85% from 47 metres.

Work underway at the Mt Chalmers copper property.

Galileo Mining

Galileo Mining Ltd (ASX:GAL) used the March quarter to turn the soil on its polymetallic Callisto discovery, part of the wholly-owned Norseman Project in WA.

The explorer is on the hunt for precious and platinum metals like palladium, platinum, gold and rhodium, as well as base metals like copper and nickel.

“I am very proud of our efforts during what was another standout quarter of drilling and exploration success at Callisto,” managing director Brad Underwood said.

“Our ongoing drilling at Callisto was rewarded late in the quarter when step-out drilling delivered an intercept of 72 metres of sulphides, a highly encouraging sign for the potential discovery of more mineralisation along strike to the north and northeast.”

Galileo has moved to step out drilling as it works to define the Callisto footprint. The explorer is fully funded to complete its planned drilling expeditions, with A$17.4 million in the bank at the end of the March quarter.

NickelSearch

Over the first three months of the year, NickelSearch Ltd (ASX:NIS) completed nearly 1,400 metres of drilling across its Carlingup nickel asset.

A fair chunk of work focused on the cornerstone Sexton target, where the explorer doubled down on significant nickel mineralisation following a down hole electromagnetic survey.

Sexton drill hole locations.

Follow-up drilling at Sexton, in addition to a maiden drilling program at the Serendipity and B1 targets, kicked off early in the June quarter as

NickelSearch also upgraded Carlingup’s indicated resource base to 8.3 million tonnes at 0.52% nickel, 0.06% copper and 0.01% cobalt.

Queensland Pacific Metals

Queensland Pacific Metals Ltd (ASX:QPM) made headway on debt financing initiatives for its Townsville Energy Chemicals Hub (TECH) project, accumulating more than $1.4 billion in conditional, indicative commitments from financiers during the quarter.

Status of QPM’s financing initiatives.

The TECH project continues to move through technical due diligence, with commercial negotiations for equipment supply contracts currently underway.

Post quarter-end, QPM inked a deal to acquire the Moranbah Gas Project and formed a strategic partnership with Carbon Logica to develop carbon abatement projects in the northern Bowen Basin.

Overall, QPM believes the acquisition is a game-changer for the TECH Project, significantly de-risking the project’s gas supply while transforming the company into a revenue generating group.

The ASX-lister remains on mission to revitalise the nickel industry and promote the sustainable production of high-grade, ethically derived battery minerals.

Apollo Minerals

Apollo Minerals Ltd (ASX:AON) used the March quarter to explore base metal gossans and new structural trends at its Kroussou zinc-lead project in Gabon.

Notably, the base metals stock pinpointed a new embayment just 1.7 kilometres north of its TP13 prospect, where a previous massive sulphide discovery measured 40% zinc and lead over 3.5 metres.

Together with a new gossan at TP10, a structural trend at TP1 and a gold discovery at TP14, Apollo believes that Kroussou represents a globally significant base metal endowment.

With only six of its 23 TPs included in the initial Kroussou target, the explorer plans to widen its footprint with regional mapping, soil sampling and drill target ranking.

Galena Mining

Galena Mining Ltd (ASX:G1A) remains focused on bringing its 60%-owned Abra Base Metals Mine into production, with construction now complete and ore commissioning underway.

The Perth-headquartered lead and silver miner remains on track to enter steady-state production in the second half of 2023 thanks to a busy March quarter, dedicated to commissioning the plant and shipping Abra’s first in-specification concentrate.

Commercial and marketing manager Charlie Kempson and Qube Geraldton Port Manager Zane Wilson overseeing the first shipment in March.

Abra’s underground development also hit a new milestone, achieving a record 1,607-metre advance during the quarter to reach 295 vertical metres below the surface.

While weather and technical impacts at the Abra mine have delayed the ramp-up to metal production, Galena plans to spend the June quarter accelerating mining and processing activities to make up for lost time.

Last month, the company executed an oversubscribed placement to fund its revised ramp-up plan, with more news to come as it finalises mine optimisation work.

Rumble Resources

Rumble Resources Ltd (ASX:RTR, OTC:RTRFF) capped off the first quarter of the new year by putting some numbers to one of the largest zinc sulphide discoveries in the last decade.

The ASX-lister released a maiden, pit-constrained inferred mineral resource estimate for its Earaheedy camp in WA, weighing in at 94 million tonnes at 3.1% zinc and lead and 4.1g/t silver.

Those metrics point to 2.2 million tonnes of contained zinc, 600,000 tonnes of lead and 12.6 million ounces of silver, highlighting Earaheedy’s tier one scale potential.

Rumble also reported some RC drilling assays, extending the zinc-lead strike at its Tonka and Navajoh deposits to more than 11 kilometres and the footprint at its Chinook target to upwards of 8 kilometres.

Next up, RTR plans to conduct resource and discovery drilling, aimed at expanding and upgrading Earaheedy’s core deposits.

Metallurgical work and scoping studies are also on the cards as the explorer reviews its early-stage development options.

Read more on Proactive Investors AU