The US Senate has unanimously passed a bill to prohibit the importation of Russian uranium, escalating measures against Russia amid its ongoing war against Ukraine.

The bill aims to cut off a key revenue stream for Russia by banning imports 90 days post-enactment, although it comes with waivers in case US nuclear reactors face supply challenges.

The legislation also allocates a previously approved US$2.7 billion (A$4.2 billion) to expand the US domestic uranium processing sector. The bill, expected to be signed into law by President Joe Biden, complements recent US efforts to aid Ukraine, including a significant foreign aid package.

The decision is part of broader sanctions that began with a ban on Russian oil imports shortly after the invasion of Ukraine in February 2022, along with a price cap on Russian crude exports. A National Security Council spokesperson had urged Congress to enforce this ban, highlighting its strategic importance.

A critical part of the green energy mix, demand for uranium is rapidly growing, and with US nuclear facilities importing about 12% of their uranium from Russia in 2022, the ban has potential to disrupt much needed supply.

Wyoming to fill the gap

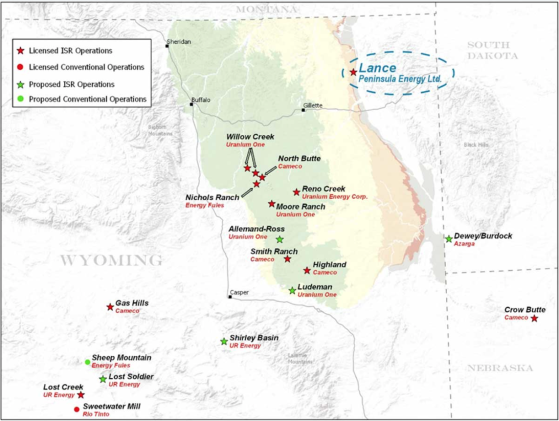

Senator John Barrasso, a Republican on the Senate Energy Committee, speculated that uranium from Wyoming — a premier uranium and mining jurisdiction — could replace Russian imports, supporting both American uranium production and the nuclear fuel supply chain. Wyoming has the largest known uranium ore reserves in the US.

Importantly, the state’s uranium deposits are generally amenable to In Situ Recovery (ISR) mining if above the ground water table and geologically amenable to control of underground leaching solutions.

ISR mining has been practised commercially in Wyoming since the mid 1980’s and is usually a low cost method (low OPEX and CAPEX), while it also has less surface impact. There are seven ISR uranium processing facilities currently operable in the state and two more licensed for construction.

While other US uranium mining states, combined, have more defined uranium resources than Wyoming, most are not amenable to ISR mining.

Wyoming uranium production being relied upon to fill the supply gap created by the ban on Russian imports is positive development for a number of ASX-listed uranium companies with projects in the state.

Peninsula Energy in a strong position to supply this market

Peninsula Energy Ltd (ASX:PEN, OTCQB:PENMF)’s Lance Project in Wyoming is one of the largest uranium projects in the United States, and is undergoing a project transformation initiative to transition to a low cost and environmentally friendly low pH ISR operation.

Once back in production, the long-life Lance Project will establish Peninsula as a fully independent end-to-end producer, supplying yellowcake product for a green energy future.

Lance is a modern, large-scale, long-life project, and is coming online during a period where the importance of nuclear as a critical element of the clean energy mix to meet aggressive decarbonisation targets continues to grow.

Peninsula will be in a strong position to supply this market and as a key competitive advantage, be the only ASX-listed uranium company providing US production and direct market exposure.

Peninsula revised the Life of Mine (LoM) plan last August, with an accelerated development path to become a fully independent producer of uranium concentrate. The LoM plan, for the Ross and Kendrick production areas, has the commencement of production at Lance in late 2024.

The robust development plan includes an accelerated production ramp-up schedule, through the availability of a complete 5,000 gallons per minute (GPM) uranium ISR plant, licensed to produce up to 2-million pounds per annum of dry yellowcake product.

With an optimised in-house processing plant, Peninsula is in a good position to take advantage of the additional Inferred 31.9 million pound Barber resource, significantly extending the Ross & Kendrick LoM modelled 10 year production life, with a lower capital cost profile than an equivalent standalone operation.

Lance Project, Wyoming, USA

GTI Energy: defining and developing economic ISR uranium resources

ASX-listed Wyoming uranium company GTI Energy Ltd (ASX:GTR, OTC:GTRIF) is focused on exploring, defining and developing economic ISR (in-situ recovery) uranium resources from its portfolio of uranium projects in the state.

The company is looking forward to the 2024 drill program at the Lo Herma Project, with a drilling services contractor now locked in. This year’s drilling program at Lo Herma includes 71 drill hole locations and construction of up to five groundwater monitoring wells.

Exploration will be focused on expanding the resource areas and upgrading the current mineral resource classification, where possible. Collection of important data including hydrogeologic parameters of the mineralised aquifers and collection of rock core samples for metallurgical testing will be also prioritised.

GTI intends to publish an updated mineral resource estimate and exploration target range for the project once this season’s drilling program is completed. The company expects that the updated mineral resource estimate will support near-term development of a scoping study to demonstrate the economic potential of the Lo Herma project.

At its Green Mountain project, GTI has maiden drilling planned for 2024 with ground truthing of drill holes now complete and the permit application close to being finalised. The 16 hole drill program is designed to test the validity of the historical Kerr McGee drill hole maps, and the interpreted mineralised regions as determined from an airborne geophysical survey.

While the US ban is a short-term measure against Russia, the move underscores the rising consideration given to commodities’ supply chains. A move away from reliance on Russian uranium is positive for uranium companies in other stable jurisdictions, including Australia.

Alligator Energy’s world-class uranium exploration

Alligator Energy Ltd (ASX:AGE, OTC:ALGEF), for example, is developing the Samphire Uranium Project in the favourable jurisdiction of South Australia. The project has a 7.5 million tonne uranium resource along with significant scope for further growth, and a scoping study that highlights the potential for a highly competitive ISR project and supports development of a 1.2 million pound per annum operation.

A pilot plant is planned for construction in the upcoming quarter, subject to approvals. One additional factor that makes any future Alligator Energy uranium production attractive is the company’s ESG credentials, which was recognised by an environmental commendation award from the state government. The company has additional uranium exploration projects across Australia.

Read more on Proactive Investors AU