Azure Minerals Ltd (ASX:AZS, OTC:AZRMF) has launched an underwritten $120 million two-tranche institutional placement for the issue of 50 million shares at an offer price of $2.40 per new share.

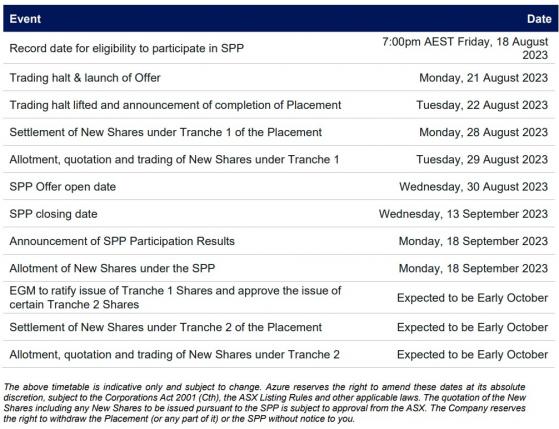

In addition to the placement, Azure will also be undertaking a non-underwritten share purchase plan (SPP) at the same price as the placement, to raise up to $10 million.

The placement and the SPP mark a critical step in the exploration and development of the Andover Lithium Project in WA and follow the announcement of multiple broad, high-grade intersections which have confirmed Andover’s potential to be a globally significant hard-rock lithium discovery.

Tranche 1 of the $120 million placement is set to raise ~$100 million and Tranche 2 will raise the balance.

Azure’s major shareholders, SQM Australia Pty Ltd (19.98% shareholding) and Yandal Investments Pty Ltd (Creasy Group) (13.37% shareholding), have each signed pre-commitment letters to participate pro-rata in the placement (SQM intends to top-up its shareholding to 19.99% post completion of the SPP via Tranche 2 in the placement).

Given Annie Guo is a related party of Azure as a non-executive director of Azure and an associate of the Creasy Group, the Creasy Group's participation will be in Tranche 2 and subject to shareholder approval for the purposes of Listing Rule 10.11.

SQM will also subscribe for a portion of its new shares in Tranche 2, to top-up to a 19.99% shareholding post completion of the SPP which would result in additional funds being raised under the placement.

SQM has indicated that it intends to vote in favour of the Creasy Group’s participation in Tranche 2.

Read: Azure Minerals intersects more broad lithium hits at Andover

Azure managing director Tony Rovira said: “Azure is delighted to announce the underwritten institutional placement, which provides a strong capital base to accelerate exploration and resource drilling at Andover as we advance towards announcing a maiden lithium mineral resources targeted in Q1 2024.

“Additionally, the placement provides sufficient funding to progress various studies at Andover, including a Scoping Study which is expected be finalised in 2024.

“The placement provides a strong endorsement for Andover as one of the best lithium exploration projects globally, with abundant outcropping mineralised pegmatites and substantial widths of high-grade mineralisation intersected from limited drilling to date.

Read: Azure Minerals lauds world-class lithium hits at Andover project; shares up

“The company remains incredibly optimistic about the potential scale of Andover and looks forward to realising the full potential of this exciting discovery. In addition to the placement, we are also pleased to offer our existing eligible shareholders the opportunity to participate in the equity raising via the SPP.

“On behalf of the Azure Board and management, I wish a warm welcome to our new shareholders and thank all our existing shareholders for their continued support.”

Read more on Proactive Investors AU