Azure Minerals Ltd (ASX:AZS, OTC:AZRMF) made headlines this morning with a 209-metre lithium hit at its Andover exploration property in WA’s Pilbara region. Shares in the company were up 9.22% this morning on the news.

The explorer has reportedly intersected its thickest zones of lithium to date, reflecting some of the best lithium drill hits globally in today’s announcement.

Drilling targeting Andover’s AP0011 pegmatite returned up to 209.4 metres at 1.42% lithium oxide from 219 metres — a reading that includes higher-grade intervals like 126.2 metres at 1.72%, 56.1 metres at 2% and 19.7 metres at 1.54% further downhole.

One other result topped the Andover charts; a 183.1-metre, 1.25% lithium oxide intersection from 170.5 metres that included 58.9 metres at 1.46%, 30 metres at 1.55% and 11.2 metres at 1.85%.

Mineralisation at Andover is now thought to extend for more than 1,800 metres along strike, while vertical depths could easily surpass 400 metres.

Results like this mean Azure is eager to get back on ground, starting with a diamond drill program over the lithium property’s Target (NYSE:TGT) Area 2 pegmatites in the coming week.

Just the beginning

Azure managing director Tony Rovira said Andover’s broad, high-grade hits firmly rank the project among the world’s best lithium exploration plays.

“Encouragingly, the results suggest the mineralisation remains open along strike and to depth, providing Azure with the potential to produce similar, if not better, lithium intersections of such scale and tenor in future drilling,” he explained.

“The Andover project is an exceptional discovery given the abundance of outcropping mineralised pegmatites and substantial widths of high-grade mineralisation intersected in the drilling.

“With multiple drill rigs on site testing the numerous pegmatite zones, we are only beginning to realise the full scale of the project’s potential.”

Taking the magnifying glass to Andover

The Andover project — 60% owned by Azure and 40% held by privately-held resources firm Creasy Group — is home to several hundred outcropping pegmatites, meticulously charted through surface sampling and mapping campaigns.

Many of these pegmatites contain high lithium grades, with the main swarm distributed across a large pegmatite field measuring up to 9 kilometres across and up to 5 kilometres from top to tail.

To date, the project has seen 40 diamond drill holes (covering 13,765 metres) and 83 reverse circulation holes (covering 16,369 metres).

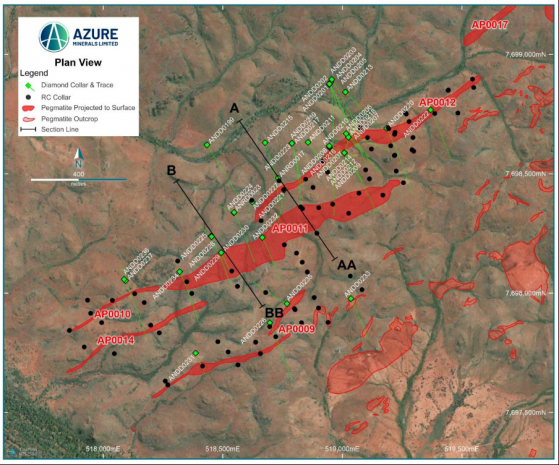

Pegmatite outcrops, drilling and section lines at Target Area 1.

Azure’s current drilling campaign is testing for lithium along a 2,000-metre-plus corridor, home to pegmatites AP0009, AP0010, AP0011, AP0012 and AP0014 in a zone known as Target Area 1.

Here, the explorer uncovered the 183-metre lithium hit within a thick, high-grade western extension, while the banner 209-metre result was revealed while targeting mineralisation down-dip from a previous hole.

Although the work is far from over, Azure has already secured heritage and environmental rubber stamps to support drilling in two more high-priority, pegmatite-rich corridors, dubbed Target areas 2 and 3.

In other regulatory news, the Department of Mines, Industry Regulation and Safety has granted Andover a third exploration licence, expanding the project’s exploration tenure to 108 square kilometres.

Andover Lithium Project showing pegmatite outcrops and target areas.

Read more on Proactive Investors AU