Azure Minerals Ltd (ASX:AZS, OTC:AZRMF) has been busy over the past few months with several highlights marking its lithium-focused programs at the joint venture Andover Project.

The project – a JV between Azure (60%) and the Creasy Group (40%) – is in the West Pilbara region of Western Australia and the JV has been busy in several areas including tenement licensing and drilling.

The most significant recent news saw the company granted Exploration Licence (EL) E47/4700 on June 26, 2023, by the WA Department of Mines, Industry Regulation and Safety.

New tenement

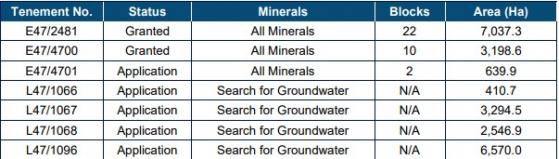

The Andover Project currently consists of two approved exploration licences (ELs) spanning 102 square kilometres. It's anticipated that a third exploration licence application (E47/4701 – encompassing two blocks for 6 square kilometres) will be approved in the latter half of 2023.

Crucially, the inclusion of E47/4700 incorporates an extra 32 square kilometres of terrain with high potential for lithium-rich pegmatites and nickel-copper-cobalt sulphide mineralisation.

“The grant of this tenement allows Azure to extend the exploration for additional large-scale lithium mineralisation into new areas where Azure’s early fieldwork identified numerous pegmatite outcrops containing spodumene,” Azure’s managing director Tony Rovira said.

“The strong prospectivity of this new area to host significant lithium deposits is supported by the presence of historical artisanal mine workings from which the associated minerals beryl and tantalite were extracted from pegmatites in the 1950s.”

In addition to the ELs, four applications have been submitted for Miscellaneous Licences for the purposes of searching for groundwater. These Miscellaneous Licences are expected to be granted in the second half of 2023.

All tenements that have been granted or applied for are included in the Andover Heritage Protection Agreement executed between Azure and the Ngarluma Aboriginal Corporation.

Andover project tenements.

Drilling continues

Two diamond core rigs and three RC rigs have been drilling along the 2,000-metre-plus-long corridor that hosts the AP0009, AP0010, AP0011, AP0012 and AP0014 pegmatites.

Currently, the rigs are testing extensions in the western half of the corridor with sequential step-outs on 200-metre-spaced sections, successfully intersecting substantial widths of the pegmatites that host the lithium mineralisation.

Standout assays from the diamond drilling program include:

- 90.2 metres at 1.23% lithium oxide in ANDD0214;

- 63.7 metres at 1.15% in ANDD0210; and

- 32.7 metres at 1.32% in ANDD0217.

These broad zones of lithium mineralisation demonstrate excellent continuity over 1,000 metres of strike extent from the surface to more than 350 metres down-dip.

Going forward, infill drilling on 100 metre-spaced sections will also be undertaken to ensure rapid delineation of the lithium mineralisation and publication of a maiden mineral resource estimate.

Given the significant results to date, Azure is assessing the feasibility of mobilising additional drill rigs to site to accelerate exploration and resource delineation.

Metallurgical test-work

Azure has also begun a multi-stage metallurgical test-work program targeting the production of a spodumene concentrate, comprising:

- Heavy Liquid Separation (HLS);

- Dense Media Separation (DMS); and

- Flotation.

Read more on Proactive Investors AU