After completing its merger with Technology Metals Australia Ltd (TMT) in February, Australian Vanadium Ltd (ASX:AVL, OTCQB:ATVVF) has delivered an updated mineral resource estimate (MRE) for the consolidated Australian Vanadium Project near Meekatharra in Western Australia.

This MRE, consolidating the two companies’ projects, lifts the high-grade measured and indicated (M&I) MRE by 39% and confirms the project as a Tier-1 high-grade vanadium deposit.

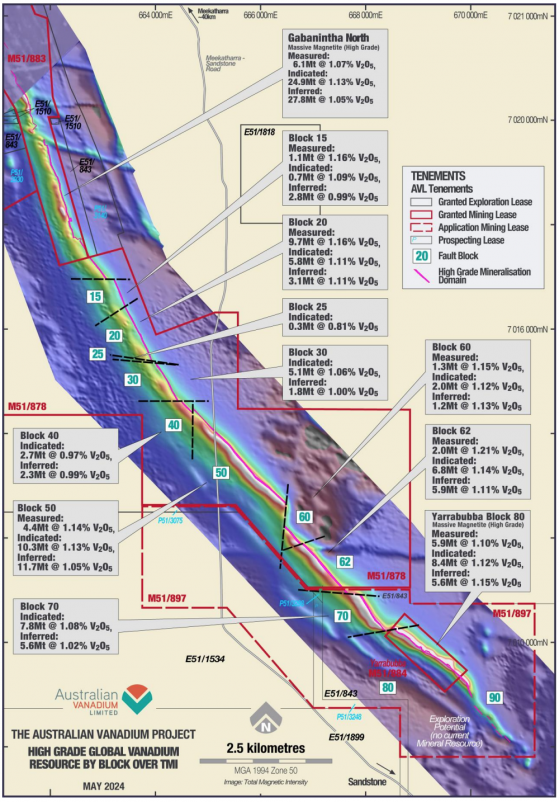

The Australian Vanadium Project combines AVL and TMT’s projects that sit within one contiguous vanadium orebody with a unified 18-kilometre strike length.

Resource update

This resource update continues to build on AVL’s aspirations to be the next primary producer of high-purity vanadium underpinned by a quality, long-life, Tier-1 asset.

The global vanadium MRE is 395.4 million tonnes at 0.77% vanadium pentoxide. Within this, 61% of the updated high-grade domain resources are now classified as measured or indicated.

AVL's MRE for the high-grade domain is 173.2 million tonnes at 1.09% vanadium pentoxide, including 105.4 million tonnes at 1.12% classified as measured or indicated.

TMI of the project and May 2024 high-grade domain MRE by block.

AVL CEO Graham Arvidson said: “AVL is pleased to provide this updated MRE for the project with significant improvements in resource category. We are particularly pleased with the significant 39% increase in classification within the high-grade domain of the deposit.

“This MRE update strengthens our conviction that we will be able to define a ‘stronger for longer’ project capable of producing high grades of vanadium and iron in the magnetic concentrate with positive economic implications.

"Increased accuracy of the MRE from additional drilling by AVL during 2022, coupled with consolidation of the MRE over the whole deposit will be pivotal in moving the optimised feasibility study forward, targeting improved early mine-life cash flow.

“AVL continues to make great progress on project development activities and approvals towards mining and vanadium oxide production while also continuing to hit key milestones in the production of electrolyte suitable for vanadium flow batteries at our electrolyte facility. The advanced stage of our project positions us well as use of vanadium in batteries continues to grow exponentially.”

AVL is progressing the project at a key time in global markets for vanadium, with growth in the vanadium flow battery (VFB) market expected to continue its rapid growth.

Optimised feasibility study

The updated MRE underpins ongoing work on the optimised feasibility study (OFS), targeting improved early mine life cash flow.

As part of the ongoing OFS work, AVL assessed the high-grade areas of the orebody, previously straddling the two projects, which shows 1.6% vanadium pentoxide and 60% iron concentrate grades.

This updated MRE consolidated AVL and TMT’s previous MREs and includes additional reverse circulation drilling, diamond core drilling and down hole density data conducted during 2022. The updated MRE also unifies the model domaining and interpretation at the project, a step needed to progress the OFS.