Australian Potash Ltd (ASX:APC) has received firm commitments to raise about $2.08 million through the placement of more than 115 million shares at an issue price of 1.8 cents per share, with a 1:1 attaching option.

The company will use the funds to support a Strategic Investment Review assessing potential strategic partners, which ideally would provide increased balance sheet capacity and industry expertise in either fertiliser feedstocks or the development of solar sulphate of potash (SOP) brines globally.

“APC’s largest shareholder, Mark Creasy, and other large and long-term shareholders on APC’s register have shown their support for APC’s strategic plans,” Australian Potash managing director and CEO Matt Shackleton said.

“We continue to advance opportunities with prospective strategic partners and investors that have the technical experience and financial capacity to assist in funding and developing the Lake Wells Sulphate of Potash Project (LSOP).”

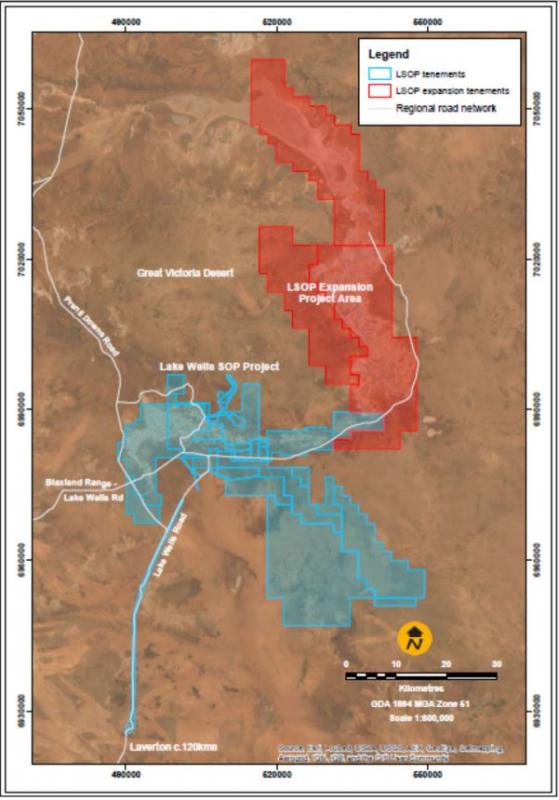

The Lake Wells SOP Project tenure with recent project expansions.

Federal funding support

“The NAIF and EFA – both Australian Federal Government funding bodies – have extended their respective approvals for debt financing until June 30, 2023, which continues to support APC’s discussions with relation to securing the total finance package required to develop the LSOP,” Shackleton continued.

“The board and management continue to have strong confidence in the LSOP’s robust development, financing and operating parameters reinforced through the review of interested parties.

“The LSOP is scheduled to produce over 200,000 tonnes per annum of SOP for at least 30 years, using less than 30% of its resource over that time.

“The growth profile for the entire APC Lake Wells Project area includes the Lake Wells East area.

Read: Australian Potash to expand Lake Wells SOP Project area by 175% to 1,905 square kilometres

“Sulphate of potash is trading at spot prices in various markets globally at between US$680 – US$940 (A$1,025 – A$1,420) a tonne, reflecting tight supply chain conditions as a result of the conflict in Europe and post-COVID logistics recovery.

“The pricing model underpinning the LSOP valuation of A$1.014 billion is based on a long-run average FOB sales price of US$567 per tonne, which assumption has not changed.”

Read more on Proactive Investors AU