Australian Potash Ltd (ASX:APC) is shifting gears and turning its focus to critical minerals upside as it weighs next steps for its Lake Wells Sulphate of Potash (LSOP) Project in WA.

The potash stock is deep in a strategic review process as it provides due diligence materials to third parties but is determined not to rest on its laurels as it awaits potential investment decisions.

Considering the project’s current status, the APC board has opted to put the potash development project on ice to preserve its inherent value, freeing it up to pursue other exploration opportunities.

With that in mind, APC has closed on a rare earths and lithium tenement that will grow its footprint in WA’s emerging West Arunta region.

Next chapter in Lake Wells story

While APC’s potash opportunities are on hold, it’s not the end of the road for the Lake Wells story.

The team completed a clay sampling program amid potash exploration at LSOP, meaning it has material on hand to conduct pXRF analysis for ionic clays.

Elsewhere, these clay structures have been shown to host lithium and rare earth element (REE) mineralisation that is typically easier to liberate than the REE and lithium found in hard rock deposits.

Given the growing demand for these critical minerals, the APC board believes it would be an opportunity lost not to conduct this analysis.

Meanwhile, south of and contiguous to the LSOP mining leases lies the Lake Wells Gold Project — a joint venture tenement that APC prospected alongside prominent Goldfields producer St Barbara Ltd (ASX:SBM).

From 2018, St Barbara has spent A$3.5 million exploring Lake Well’s gold potential along the massive Yamarna shear zone.

Fast forward to today, and with sole control of the Lake Well gold tenements, APC is in talks with third parties to bring the asset into a new exploration chapter.

These discussions remain ongoing and should no commercially acceptable terms materialise, the company may consider undertaking further exploration at its own cost.

New opportunity at Nexus

Reflecting its renewed focus on critical mineral opportunities, APC has named its newly minted tenement the Nexus Project.

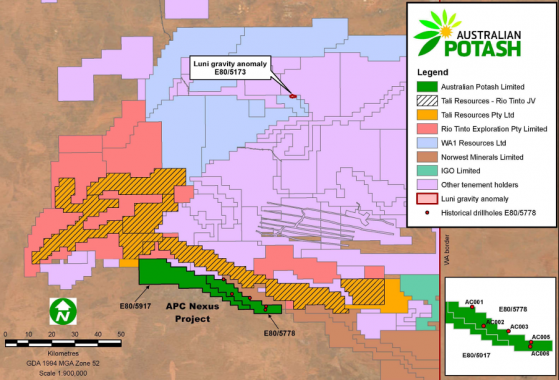

APC’s Nexus Project rubs shoulders with resources stalwarts WA1 Resources, Rio Tinto (ASX:RIO) Exploration and IGO in WA’s West Arunta region.

The wider region has garnered attention recently thanks to WA1 Resources Ltd’s high-grade, carbonatite-hosted niobium discovery.

WA1’s focus lies around 80 kilometres north of APC’s new tenure in an area that’s also subject to an exploration joint venture between a private company and Rio Tinto Exploration Pty Ltd.

What’s more, major Western Australian nickel and lithium producer IGO Ltd has tenure to the east of the Nexus Project, reflecting growing interest in this emerging minerals province.

Nexus has a bit of a backstory; it was partially explored by Canadian base metals player First Quantum Minerals (TSX:FQM) (FQM) between 2015 and 2016 when the team drilled five holes at the tenement as part of a broader drilling campaign.

While ostensibly exploring for a large copper system hosted in the basement, FQM submitted 526 samples for multi-element assay.

Several samples returned anomalous lithium and total rare earth oxide (TREO) assays, while further work conducted by ASX-listed NorWest Minerals Ltd last year showed that TREO mineralisation increased in concentration with increasing distance from the Webb Granite contact.

Nexus Project bedrock geology and FQM drill collar locations.

As such, APC’s strategy at Nexus is to expand the work conducted by FQM and NWM by pursuing the increasing tenor of lithium and rare earth mineralisation to the south of the Webb Granite.

The company will provide further updates to the market on its expanded exploration focus in coming months and as results become available.

Read more on Proactive Investors AU