Australian Potash Ltd (ASX:APC) would deliver "superior" economic outcomes by lifting the proposed annual rate of sulphate of potash (SOP) production by 21% at its Lake Wells SOP Project, northeast of Kalgoorlie in Western Australia.

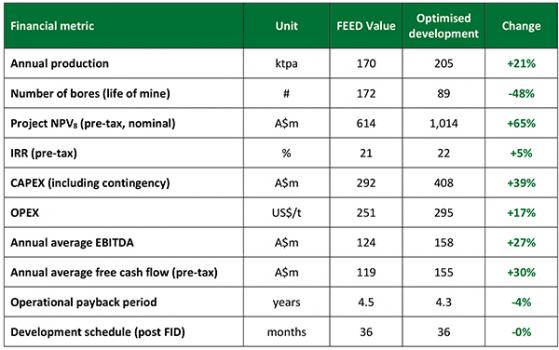

The company intends to increase the annual SOP production rate to 205,000 tonnes from 170,000 tonnes, supporting economic outcomes described by APC as superior.

At the field, borefield development has been optimised, reducing the number of production wells required in steady state operations to 89 from 172 over the life of mine.

The project is a long-life operation of more than 30 years, with strong economics, producing organically certified, environmentally sustainable, green SOP that will go to the world’s most productive and high-value markets.

“Valued at over a billion dollars”

Australian Potash managing director and CEO Matt Shackleton said: “The food security thematic is compounding global supply chain disruption caused by the pandemic and the conflict in eastern Europe.

“SOP pricing is at record levels in many markets.

“The short and medium-term outlook for inflation in construction and operating costs has also increased since the FEED was published in April 2021.

“Accordingly, we have updated SOP pricing assumptions, capital cost base and operational cost base of the Lake Wells model to reflect prevailing market conditions.

“Pleasingly, the SOP price outlook, upgrades to flow rates and brine grades and increased economies of scale offset a large proportion of the capital and operational cost inflation.

“The project is estimated to be valued at over a billion dollars, generating an average of $158 million EBITDA pa with a mine life of 30 years.

“The LSOP remains one of the world’s pre-eminent primary SOP project developments, which still carries Australia’s largest JORC-compliant SOP measured mineral resource.

“The significant learnings gained through witnessing and analysing peer developments, in addition to the expertise now available locally, underpins our conviction and momentum towards a final investment decision to proceed to development.”

Hydro model

In the second half of 2021, APC kicked off an early works program focused on the development of 16 additional production bore site accommodations, and power and water treatment infrastructure.

Data obtained through the bore development and testing program, including hydro stratigraphic, flow rate and brine composition information, was used to reiterate the hydrogeological flow model (hydro model) that underpins the planning and development of the Lake Wells SOP Project.

The hydro model was first developed through the scoping study conducted on the LSOP

Read more on Proactive Investors AU