Auric Mining Ltd (ASX:AWJ) has received total cash proceeds of $4.77 million from stage one mining of its Jeffreys Find Gold Mine near Norseman in Western Australia and is now positioned to be self-funding in 2024.

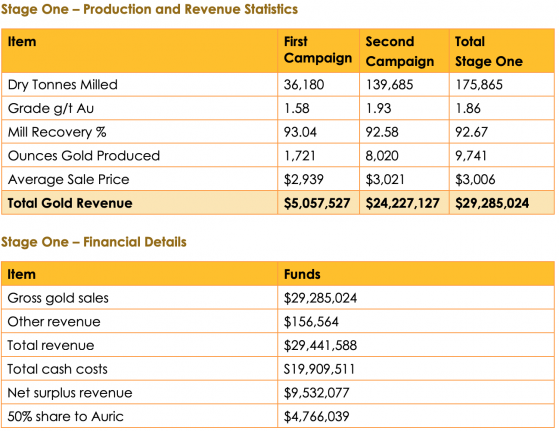

Through Auric’s joint venture with BML Ventures Pty Ltd of Kalgoorlie, a total of 9,741 ounces of gold was produced in two campaigns with the ore processed at the Greenfields Mill, Coolgardie.

The gold was sold at an average price of $3,006 per ounce to bring in gross revenue of $29.28 million, with total surplus cash of $9.53 million to be split by the partners.

In the first campaign, 36,180 dry metric tonnes were processed at a reconciled head grade of 1.58g/t for 1,721 ounces of gold at a calculated recovery of 93.04%.

In the second campaign, 139,685 dry metric tonnes were processed at a reconciled head grade of 1.93g/t for 8,020 ounces of gold at a calculated recovery of 92.58%.

In addition to the $4.77 million received, a further final payment will be made to Auric of $1.39 million, taking the total to $5.24 million.

A fantastic result

Auric managing director Mark English said: “What a fantastic result! To produce 9,741 ounces of gold in stage one of mining and Auric receiving $4.7 million, being its share of total surplus cash distributions, is a terrific achievement.

“Stage One of mining has taken six months - not long to generate almost $30 million in gross revenue and $9.5 million in total surplus cash to be split by the partners. The second campaign returned a head grade of 1.93 grams per tonne, way ahead of the first campaign which produced at 1.58 g/t.

“Better still was an average gold price of $3,021/ounce for the second parcel which yielded more than 8,000 ounces. Perth Mint sold gold at $3,131/ounce, the highest price for gold bullion received in Australian dollars at the time.

“The timing was excellent. We are extremely happy with the capability of BML. They are an excellent small miner and partner. Planning is well underway for 2024. BML are working on the parameters for a final pit. Considering the Stage One pit was premised on a gold price of $2,600/ounce, we may see a more expansive approach to mining in 2024.

“Auric has achieved what very few other junior miners have ever done – gone from tenement acquisition to IPO listing, production, then cash in the bank in just three years. We are now self-funding, which cannot be overemphasised in this tight financial market.”

Read more on Proactive Investors AU