AuKing Mining Ltd (ASX:AKN) is expanding its portfolio of uranium assets, announcing the proposed acquisition of a 100% interest in the Grand Codroy uranium exploration project in Newfoundland, Canada.

AuKing managing director Paul Williams said that with the strong industry sentiment emerging from last week’s World Nuclear Association symposium in London, there is likely to be renewed levels of interest for uranium projects.

The company already has a significant position with its Mkuju uranium project in Tanzania and Williams expressed the company’s excitement at being able to secure the Grand Codroy project in North America.

With the global search for sources of uranium mineralisation in full steam he welcomed the opportunity to commence exploration activities after the completion of the acquisition.

Grand Codroy uranium exploration project

The uranium mineralisation at the project is within extensive, organic-rich siliciclastic rocks, which is similar to the sandstone-hosted uranium districts in the western United States.

Notable high-grade historical rock samples collected from the project area include more than 22,000 parts per million (ppm) (2.2%) copper and 595 ppm uranium.

The project presents significant exploration potential, with the Grand Codroy tenure area largely untouched by modern exploration. North of Grand Codroy in western Newfoundland, Infini Resources Ltd (ASX:I88) has reported impressive results at its Portland Creek uranium project

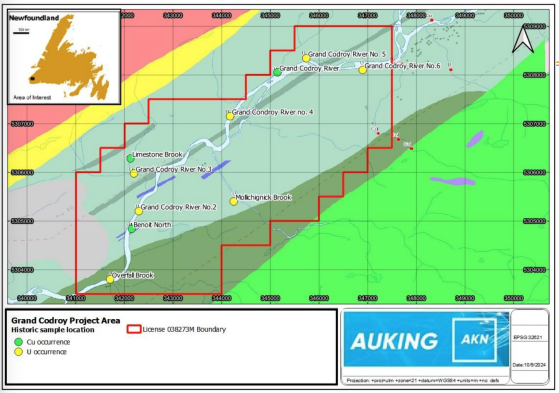

The mineral claim is strategically situated some 50 kilometres north of Port aux Basque, Newfoundland. Infini is well advanced with a major surface geochemical sampling program and reporting results such as a 74,997 ppm Triuranium octoxide (U3O8) assay result.

The project site offers excellent accessibility with well-maintained road infrastructure leading directly to the area.

Grand Codroy uranium project, showing historical uranium and copper occurrences across the tenure.

Capital raising

In support of the acquisition, the company has completed a placement to sophisticated and professional investors to raise $130,000 (before costs) through the issue of 16,883,116 shares at an issue price of 0.77 cents each. Melbourne's boutique Peak Asset Management led the placement.

AuKing has proposed to soon conduct an upcoming entitlement offer to existing shareholders to raise funds needed to commence the proposed exploration activities across the company’s portfolio of projects.

The offer — to raise around $1,487,206 less costs — is expected to comprise a non-renounceable rights issue to eligible shareholders of two new shares for every three shares held at an issue price of $0.007 per new share (together with free-attaching options exercisable at $0.03 on or before 30 April 2027, to be issued on the basis of one new option for every two new shares issued).

While AuKing intends to direct initial funds and resources towards the proposed activities at Grand Codroy, the initial work to be conducted is not expected to exceed $30,000 for the balance of 2024.

The planned activities at the company’s other project areas, especially the Mkuju uranium drilling in Tanzania, will proceed assuming fundraising is successfully completed.

Read more on Proactive Investors AU