Highlights:

- The growing popularity of electric vehicles is boosting the demand for lithium-based batteries

- Many ASX-listed lithium-focused players are undertaking aggressive moves to boost their journey in the hot battery mineral market

With a growing inclination toward net-zero emissions and sustainable energy sources, the lithium market has witnessed a boom which is likely to continue. Demand for lithium globally continued to grow sharply in the September quarter of 2022, backed by rising demand for electric vehicle batteries, as per the Resources and Energy Quarterly December 2022 edition.

The report highlighted a 40% year-on-year increase in global sales of all types of electric vehicles in the nine months to September 2022.

The report estimates global lithium demand to increase by 40%, reaching 1,091,000 tonnes by 2024.

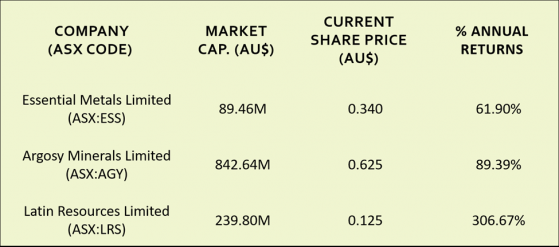

With this backdrop, let us discuss a few ASX-listed lithium penny stocks that made significant gains in 2022.

ASX, as of 6 January 2023

Essential Metals Ltd (ASX:ESS)

Essential Metals Limited, a mining exploration company based in Australia, is committed to making its place in the global lithium supply chain. The company has three lithium and gold projects in Western Australia with 100% ownership. Essential Metals also has four gold and two nickel joint venture projects.

The current Mineral Resource Estimate of the company’s Pioneer Dome lithium project stands at 11.2 Mt at 1.16% lithium oxide, containing 129,000 lithium tonnes.

At the Pioneer Dome lithium project, the company has identified and ranked over 40 targets through a structural geology study. The field checking has identified several new pegmatites. The company is progressing to make the site ready for development. It has also identified the intersection of two Proterozoic dolerite dykes as priority targets for lithium-caesium-tantalum.

The company expects assays from field samples in January and February.

Image: © Erchog | Megapixl.com

Argosy Minerals Ltd (ASX:AGY)

Australian company Argosy Minerals has interests in the Rincon Lithium project, Argentina, and the Tonopah Lithium project in the United States. The Rincon project is the company’s flagship asset, believed to be a potential game-changer in the lithium market.

As per the latest update on progress across the Rincon Lithium Project, Argosy Minerals has wrapped up 98% of total works targeted at developing a lithium carbonate production operation.

The facility will have an annual capacity of 2,000 tonnes.

During commissioning and production test works, the company unveiled the successful production of a battery quality 99.76% lithium carbonate.

The company believes it is on track to emerge as the second ASX-listed battery-quality lithium carbonate producer.

Latin Resources Ltd (ASX:LRS)

Mineral exploration company Latin Resources has projects in South America and Australia. It is focused on its flagship Salinas project, where a resource drilling campaign is also underway. Latin Resources aims to discover, delineate, and develop mineral commodity projects that enable the transition to net-zero emissions.

The company announced estimates of JORC Indicated and Inferred Mineral Resource Estimate of the Colina lithium project, reporting 13.3 Mt at 1.2% lithium oxide. There is a significant upside growth potential at the Colina project, as per the company.

The company indicates that the Colina West drilling campaign validated the continuity of thick spodumene pegmatites of high grade.

Latin Resources has planned an aggressive 65,000m drilling campaign for 2023 to fast-track rapid resource growth at the Colina project.