From ancient to modern civilisations, gold has long captured the attention of those seeking to materialise their wealth.

Not just a status symbol, this precious yellow metal has become the gold standard in safe haven investments, inviting those eager to protect their wealth to bank on something tangible.

But strong demand for safe havens doesn’t always translate to a prime market for gold explorers and developers — each of which is eager to discover the next major ore source and mint their first gold bars.

So, in a crowded market of Aussie goldies, which ASX-listers hit their stride and got the gold in FY23’s final quarter?

Give me the elevator pitch

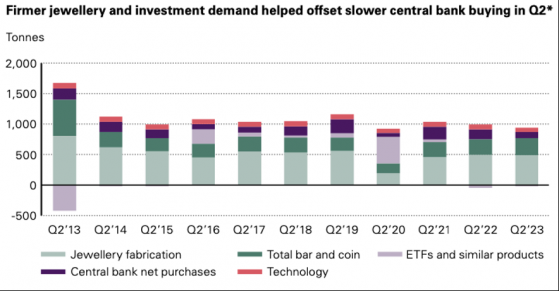

The World Gold Council — largely considered the authority on the precious yellow metal — says gold continued to perform globally as central bank buying rounded out a record first half.

The council’s latest Gold Demand Trends report reveals that gold was supported by healthy investment markets and resilient jewellery demand, despite overall stats dropping 2% year-on-year in 2023’s second quarter.

Source: Metals Focus, Refinitiv GFMS, World Gold Council.

Total gold supply was 7% higher year-on-year at 1,255 tonnes in Q2, with mine production estimated to have reached a first-half record of 1,781 tonnes.

Senior markets analyst Louise Street said: “Record central bank demand has dominated the gold market over the last year and, despite a slower pace in Q2, this trend underscores gold's importance as a safe haven asset amid ongoing geopolitical tensions and challenging economic conditions around the world.”

“Looking ahead to the second half of 2023, an economic contraction could bring additional upside for gold, further reinforcing its safe-haven asset status.”

“In this scenario, gold would be supported by demand from investors and central banks, helping to offset any weakness in jewellery and technology demand triggered by a squeeze on consumer spending.”

In terms of gold investment, bar and coin demand increased 6% year-on-year to 277 tonnes in Q2 thanks to growth in key markets, including the US and Turkey.

The World Gold Council’s head of Asia-Pacific (ex-China) and global head of Central Banks, Shaokai Fan, said gold had experienced an exceptional run thus far, especially with Australian metrics up 7.2% in 2023’s first half.

“However, this has also provided attractive selling opportunities for investors,” he cautioned.

“Total holdings in Australian gold-backed ETFs remained steady at 41 tonnes, down just 0.5% over the quarter, signalling continued appetite for physical gold as a means of investment diversification and a resilient store of value in portfolios.”

In the spotlight: ASX gold stocks

Bellevue Gold

Bellevue Gold Ltd (ASX:BGL) remains on schedule to mint its first gold bar in 2023’s December quarter thanks to plenty of hard work over the last three months.

Construction progress at the Bellevue processing plant.

Much of the June quarter was spent constructing a 1-million-tonne-per-annum processing plant and advancing Bellevue’s underground mine, putting the gold stock on track to achieve major producer status by year’s end.

The West Aussie gold stock is on a mission to deliver ‘green’ gold from its namesake production hub: in May, the company shook hands with a tier-one power provider to service up to 80% of Bellevue’s power requirements with renewable energy.

Bellevue has also joined the Electric Mine Consortium, which is made up of 20 progressive ASX-listers and private resources companies dedicated to decarbonising the industry.

In other June quarter news, Bellevue ticked off the final permitting box on its to-do list, fielded up to 1,130 g/t gold in a grade control drilling campaign and kicked off mining at the Vanguard open pit.

“With first production now just around the corner, we are continuing to meet all our key targets, including timetables and budgets,” managing director Darren Stralow told investors last week.

“Our strategy will see Bellevue become a 200,000-ounce-a-year producer with very robust margins, strong free cashflow and a long mine life.

“These are extremely attractive metrics and we are determined to deliver them for the benefit of all our stakeholders.”

After the quarter wrapped, Bellevue inked a toll treating agreement with Genesis Minerals (ASX:GMD) Ltd, paving the way to early cashflow at a pivotal time for the ASX200 gold stock.

Brightstar Resources

Brightstar Resources Ltd (ASX:BTR) also has plans to move into the gold production space: it’s looking to restart mining operations at Menzies Gold Project in WA, where a historical high-grade field produced nearly 780,000 ounces in its heyday.

The ASX-lister is on track to become Australia’s next gold producer in Q3, with plans to excavate 30,000 tonnes of ore at a head grade of more than 6 g/t from the Selkirk Open Pit mine.

But operations aren’t the only endeavour front of mind — in June, Brightstar commissioned the RC drill bit to carry out a 5,000-metre-plus campaign to boost Menzies’ 965,000-ounce gold inventory.

The proof is in the pudding at Brightstar’s Cork Tree Well deposit, where infill and extensional drilling boosted the gold resource beyond the 1-million-ounce mark in Q4.

All of this comes just months after Brightstar merged with Kingwest Resources, consolidating their respective Laverton and Menzies gold projects.

Kingwest chairman Gregory Bittar said the merger of equals was the first step towards creating a “larger and more diverse junior gold company”.

“At a time which appears to mark a positive momentum shift for gold equities globally, the opportunity to combine the assets of Kingwest and Brightstar presents a significant value opportunity for all shareholders."

Post-quarter end, Brightstar expanded its gold and lithium footprint at Menzies through a non-core tenement swap with Ardea Resources. It’s also partnered with DevEx Resources Ltd to advance ex-gold rights on its Goongarrie Project in WA.

Catalyst Metals

Catalyst Metals Ltd (ASX:CYL)’s focus on gold in Australia’s east and west makes it a rare breed.

The precious metals explorer and producer is developing the Plutonic Gold Mine in WA, boasting a 5.9-million-ounce gold resource, 630,000 ounces in reserves and a 3-million-tonne-per-annum carbon-in-leach (CIL) processing capacity, spread over two plants.

Much of the quarter was spent dotting the I’s and crossing the T’s on the company’s Superior Gold acquisition, designed to revitalise the underloved WA gold belt and synthesise a high-grade, low-cost mining operation at Plutonic.

Across state borders in Victoria, Catalyst is locked on the historical 22-million-ounce Bendigo Goldfield, where its Four Eagles project is gaining traction thanks to bonanza gold hits up to 1,840 g/t.

Soon after that result, Catalyst established a maiden 163,000-ounce resource at Four Eagles, marrying resources from the highly prospective Boyd’s Dam and Iris gold zones.

Managing director and CEO James Champion de Crespigny called the Four Eagles resource “a significant milestone” for the company.

“I’m sure many of Catalyst’s long-standing shareholders would join me congratulating my fellow director Bruce Kay and his team within Catalyst on this wonderful discovery.”

Since kicking off FY24, Catalyst has delivered a promising scoping study for Plutonic’s Trident underground deposit, which highlighted a relatively low capital cost that leverages the project’s existing infrastructure.

A definitive feasibility study is in the works to support a final investment decision, with first ore targeted in the final quarter of 2024.

Horizon Minerals

Horizon Minerals Ltd (ASX:HRZ) has its sights set on obtaining gold producer status by transforming a sequence of WA mines into high-grade, low-tonnage assets, leveraging nearby infrastructure to monetise the gold via toll milling.

The ASX-lister plans to kick things off with its Cannon underground mine — an asset that’s now fully funded thanks to a US$3 million loan facility drawdown during the June quarter.

Cannon is also fully greenlit for development, with the project’s works approval, discharge licence, groundwater licence, mining proposal and mine closure plan all securing the rubber stamp.

Horizon CEO Grant Haywood said the company was pleased to receive the funding on “competitive commercial terms”.

“This now leaves Horizon with the startup capital and approvals needed to advance the Cannon gold project into development and production in the second half of 2023.”

The funding further bolsters the bank balance after Horizon completed an A$3.34 raise in March 2023, earmarking cash for Cannon and its Penny’s Find drilling campaign.

Growth focused exploration began at Penny’s Find in May, designed to prove up the gold asset as the second in line in Horizon’s development strategy. A resource update is due this quarter after a round of extensional, brownfields-focused drilling last quarter.

Since the June quarter wrapped, Horizon has declared maiden resources for its Monument and Golden Ridge North prospects, giving it more satellite ore options to complement a future underground production hub at Cannon.

Kin Mining

A 1.54-million-ounce gold resource was the banner result from Kin Mining NL (ASX:KIN)’s latest quarterly report, which recapped highlights from the cornerstone Cardinia Gold Project in Leonora, WA.

The gold explorer added 134,000 contained ounces to the Cardinia resource estimate in July, boosting the project’s higher-quality measured and indicated gold in the process.

Much of the June quarter focused on exploration in the highly prospective Eastern Corridor, where aircore drilling has since confirmed two new mineralised trends.

A third mineralised structure has also been identified, pointing to potential camp-style gold along 5 kilometres of strike.

Moving into the new financial year, there’s new leadership at the helm: Kin has appointed highly experienced mining executive Rowan Johnston as its new executive chairman and bid farewell to managing director Andrew Munckton, who will finish up in August.

"The board has commenced the search for a new leader with the appropriate skills that can continue to drive the company to the next level.”

In other boardroom news, non-executive director Nicholas Anderson will move into a business development executive role, designed to find value-accretive opportunities for Kin shareholders in the Leonora gold district.

Musgrave Minerals

Musgrave Minerals Ltd (ASX:MGV, OTC:MGVMF) has completed plenty of activity at its 927,000-ounce Cue Gold Project in WA, where a pre-feasibility study and infill and extensional drilling made for a busy quarter.

Cue’s stage one PFS — released in mid-April — confirmed the project’s status as a financially attractive standalone asset with an initial five-year mine life.

The latest financial and production metrics demonstrate the Murchison gold camp could deliver low-cost, high-margin gold and A$314 million in pre-tax free cash flow, as well as an A$235 million pre-tax net present value and a 95% internal rate of return.

Since the PFS’ release, Musgrave has launched an updated 3D model of its cornerstone gold camp, incorporating the study’s design and the latest geoscientific data.

Extensional and infill drilling — most notably over the Break of Day, Lena and Leviticus deposits — has also generated exciting gold hits, teeing the company up for further exploration in the September quarter.

Work at Cue has sparked to plenty of interest early in the September quarter, most notably from top 10 gold producer Ramelius Resources Ltd.

A takeover bid lobbed in early July valued Musgrave at A$201 million, and the board has since recommended that Musgrave shareholders accept the offer.

Under the Ramelius bid, shareholders will receive one Ramelius share for every 4.21 Musgrave shares held, in addition to A$0.04 in cash per Musgrave share.

Musgrave directors believe Ramelius has the financial, operational and exploration expertise to continue the Cue story by expanding and developing its sizeable gold bounty.

Ora Banda Mining

Ora Banda Mining Ltd (ASX:OBM) closed out FY24 with a 49% increase in mined ounces over the last three months of the financial year.

The West Aussie gold stock spent the June quarter enacting its 'DRIVE to 100' strategy — a roadmap to grow its production profile to more than 100,000 ounces per annum by FY25.

Central to that vision is OBM’s Riverina underground mine, which entered development in mid-May. Mining has since progressed as expected, excavating 265 metres over a six-week period.

On the open-pit front, OBM mined roughly 16,700 ounces from its Missouri asset and sold 12,050 gold ounces over the June quarter.

The Missouri open pit.

All of this underpins a 40% increase in OBM’s FY24 production guidance, which has been upgraded to between 67,000 and 73,000 ounces for the year. Simultaneously, the gold stock is forecasting a 25% reduction in its all-in sustaining cost, downgraded to between $2,200 and $2,400 an ounce.

Ora Banda managing director Luke Creagh said the June quarter concluded a big year for the company.

“The outstanding achievements made by the team across this period and the whole of FY23 cannot be understated; they have placed the Company in a strong position moving into FY24," he explained.

“After a period of substantial change in FY23, we are excited to have built a strong platform and established team that are committed to delivering our immediate growth strategy to more than 100 thousand ounces in FY25.”

In other news, Ora Banda recently parted ways with four non-core tenements in a A$2.5 million sale to Beacon Minerals Ltd (ASX:BCN).

The gold stock ended the quarter with A$24.7 million in cash, with a further A$9 million expected once it completes the Lady Ida project sale around mid-August.

Nova Minerals

Nova Minerals Ltd (ASX:NVA, OTCQB:NVAAF)’s June quarter highlight was a phase two scoping study for its premier Estelle Project in Alaska’s Tintina Gold Belt.

The study, based on a mining scenario that prioritises Estelle’s higher grade, at-surface deposits, confirmed the potential for a commercially robust mining operation with an 11-month payback period and strong financial and mining metrics.

Since the study was released, Nova has moved on to its 2023 field season, designed to prove up Estelle’s walk-up targets, boost the mill feed grade and optimise metallurgical test-work.

Technically speaking, Nova estimates improvements to these parameters will have the greatest impact on the project’s bottom line.

Multiple drill rigs are focused on the RPM district, where the highest priority target remains a 600-metre corridor of open, prospective strike between the RPM North and RPM South targets.

At the top of the quarter, the gold stock also boosted the global gold resource at Estelle to a whopping 9.9 million contained ounces, building out the asset’s precious metals profile ahead of the phase two scoping study.

Nova CEO Christopher Gerteisen said the company was committed to exploring its large and underexplored land package; ground that has the potential to become “one of the largest gold districts on the planet.”

“Nova’s 2023 drill program gives our shareholders much to look forward to as we simultaneously build on recent successes and position ourselves to make additional discoveries.”

Post quarter-end, Nova discovered visible gold at the RPM deposit, where the explorer continues to spin the drill bit in a bid to expand and delineate a high-grade gold resource.

Perseus Mining

Perseus Mining Ltd (ASX:PRU, TSX:PRU, OTC:PMNXF) spent the quarter driving production across its three operating gold mines: Yaouré and Sissingué in Côte d’Ivoire and Edikan in Ghana.

The company’s June quarter’s gold production metrics came in at 136,634 ounces, while production and all-in-sustaining costs significantly outperformed market production and cost guidance for the June 2023 half-year (and FY23 overall).

Meanwhile, quarterly gold sales of 140,533 ounces were up 4% on the March 2023 quarter. The company also reported robust quarterly cashflows, strengthening its net cash and bullion balance by US$51 million. At the end of the quarter, Perseus held US$522 million in cash and bullion with zero debt.

In addition, the company’s total economic contribution to its host countries of Ghana, Côte d’Ivoire and Sudan landed at roughly US$158 million, representing around 58% of revenue during the three-month period.

Some of the quarter’s organic growth activities included mineral resource drillouts and feasibility studies for the Yaouré CMA Underground Project, which are progressing on schedule.

Predictive Discovery (ASX:PDI)

Predictive Discovery Ltd (ASX:PDI, OTC:PDIYF) spent the June quarter preparing for an all-important resource update at its 4.2-million-ounce Bankan Gold Project in Guinea.

The gold stock conducted resource definition drilling across the NE Bankan (NEB) and Bankan Creek (BC) deposits, where diamond and reverse circulation assays continue to deliver strong infill results.

However, resource drilling wasn’t the only program on the cards; PDI also covered regional exploration ground with a first-pass campaign at the 800W target.

Simultaneously, a ground geophysics program at the regional Argo target firmed up 23 surface anomalies and confirmed they extend to depths.

Much of this quarter’s exploration campaign was supported by a A$40.4 million placement, designed to accelerate growth across PDI’s West African gold project.

Managing director Andrew Pardey said the last three months reflect considerable progress in Predictive’s mission to transform Bankan into a tier-one gold deposit.

“The drilling programs further confirm the resource quality at NEB and BC, and we have commenced exploration drilling with the aim of discovering additional commercial deposits near the existing resources and in the Argo permit, where we have 11 priority drill targets.”

PDI plans to conduct further resource definition drilling in the current quarter, charting the course for a pivotal update that’s poised to boost indicated gold grades and contained ounces.

Read more on Proactive Investors AU