Australia’s mineral exploration companies are amidst some of the most favourable conditions in a decade, with investors pumping billions of dollars for the next generation of discoveries.

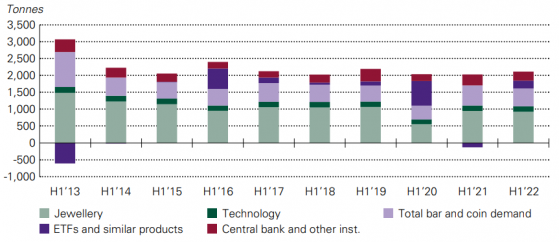

Despite the slump in demand for gold during the June quarter, strong first-quarter ETF inflows have fuelled a notable first-half recovery.

During the quarter, demand for gold was lower by 8%, at 948 tonnes, compared to the corresponding period in 2021.

However, combined with the March quarter figures, the cumulative first-half demand for gold in 2022 is 2,189 tonnes, up 12% compared to corresponding half-yearly figures in 2021.

ETF's fuelled a notable H1 recovery

Source: World Gold Council

Safe-haven demand to continue

The first half of 2022 ended well for gold, with bar and coin, ETF and OTC demand combined posting the third largest first-half since 2010.

Even if inflation decelerates, consumer prices remain high and are impacting asset allocation decisions.

Additionally, a near-term resolution to the Ukraine war is distant, while further economic weakness is likely in Europe and the US as well as China.

This should support investor preference towards gold investment and central bank buying of the metal.

Central bank buying continued to be strong in H1 2022.

In the spotlight: ASX gold explorers

Ozaurum Resources Ltd (ASX:OZM)

OzAurum Resources Ltd (ASX:OZM) has continued its strong quarterly performance for the quarter ending June 30, 2022, delivering strong results from its Mulgabbie North Gold Project in Western Australia.

During the quarter, the company uncovered a new virgin gold discovery with significant wide zones of primary gold mineralisation intersected during reverse circulation (RC) drilling at the Mulgabbie North Demag Zone.

Standout assays include:

- 56 metres at 1.31 g/t gold from 68 metres including, 18 metres at 2.07 g/t gold;

- 26 metres at 1.79 g/t from 136 metres, including, 8 metres at 4.78 g/t; and

- 28 metres at 1.00 g/t from 72 metres, including, 4 metres at 2.32 g/t.

Also, the first diamond drill hole at the Mulgabbie North Demag Zone delivered exceptional gold results, with best intersections including 55 metres at 1 g/t gold from 47 metres, including 4 metres at 4.98 g/t.

Follow-up reverse circulation (RC) drilling at the Mulgabbie North Demag Zone is a high priority, along with ongoing RC drill-testing of AC saprolite gold anomalies and extensions to the Ben and James Prospects.

What’s more, OzAurum kicked off an additional nine-hole RC drilling program across 1,900 metres in mid-July.

Drilling at Mulgabbie North.

Meeka Metals (ASX:MEK)

Meeka Metals Ltd (ASX:MEK) delivered a busy June quarter, highlighting strong gold and rare earth potential across its highly prospective portfolio in Western Australia.

During the quarter, the company was active in advancing both gold and rare earth opportunities initially at Circle Valley before moving to the Murchison late in the quarter.

Drilling recommenced at the Murchison Gold Project in June, focusing on the growth of high-grade 1.1-million-ounce gold mineral resource, delivering bonanza grade hits of up to 63 g/t from diamond drilling at the Turnberry deposit.

Also, drilling at Circle Valley gold continued to deliver shallow, high-grade gold hits below 1.2 kilometres by 400 metres surface anomaly with strong rare earths to boot.

Encouraged by these results, Meeka secured additional tenure over key targets to the north, expanding the Circle Valley landholding by 33% to 222 square kilometres.

Subsequent to the reporting period, Meeka has hit “exceptionally high-grade gold” at the St Anne’s target, part of the Murchison Gold Project.

Some of the best intersections include:

- 32 metres at 16.07 g/t gold from 48 metres, including 16 metres at 28.59 g/t; and

- 20 metres at 20.74 g/t from 48 metres, including 16 metres at 24.86 g/t.

Drilling at St Anne’s targeting shallow high-grade gold.

Strickland Metals Ltd (ASX:STK)

Strickland Metals Ltd (ASX:STK) delivered “outstanding” gold results during the June quarter, advancing its Millrose Gold Project, situated on the northeast flank of the Yandal Belt in Western Australia.

During the quarter, the company fielded strong initial gold results from its 2022 drill program at the Millrose Project including:

- 55 metres at 2.4 g/t gold from 86 metres

- 31 metres at 1.8 g/t gold from 93 metres; and

- 35.1 metres at 1.94 g/t from 136 metres.

Subsequent to the reporting period, Strickland intersected multiple new gold zones and high-grade oxide zones at the project.

Historic drilling across the Millrose Gold Deposit intersected a coherent zone of +1g/t gold shallow, laterite gold mineralisation that has been defined over at least 300 metres in strike.

Given that this mineralisation is near-surface and high grade, any potential laterite gold resource estimate will provide Strickland with upfront cash flow for the wider Millrose mineral resource in a development scenario.

Also, subsequent to the reporting period, Strickland has cleared the way for an expedited drilling program at the Millrose, having received native title heritage clearance from the Tarlka Matuwa Piarku (Aboriginal Corporation) and approval for a program of work from the Department of Mines, Industry Regulation and Safety.

Moving ahead, a third RC drill rig has arrived on site to aid in the accelerated drill testing of the Millrose structural corridor.

Millrose cross section showing high-grade depth extension in hole MRDD00.

Nova Minerals Ltd (ASX:NVA)

Nova Minerals Ltd (ASX:NVA, OTCQB:NVAAF) has had a “transformational” June quarter, aiming to increase the size and confidence of both the Korbel and RPM deposits situated within the Estelle Gold Project for inclusion in a phase two scoping study, due out later this year, and the PFS in 2023.

The company’s drilling at Korbel recommenced in mid-May to infill the saddle area within the proposed conceptual Korbel Main pit zone with the goal being to convert additional inferred resources from the 8.1 million total gold resource into a higher indicated category.

Meanwhile, RPM drilling recommenced in mid-June west of the major discovery hole RPM-005 at RPM North, where the company previously hit a standout intersection of 132 metres at 10.1g.t.

At the office, Nova ended the quarter in a strong financial position, well-funded with $21.3 million in cash.

Looking ahead, the company is fundamentally running on a schedule to unlock the Estelle Gold Trend, a major gold trend in a safe jurisdiction.

Infill Drilling underway around RPM-005 hole.

Sunstone Metals Ltd (ASX:STM)

Sunstone Metals Ltd (ASX:STM) is well funded with about $24 million in cash at the end of the June quarter, advancing its portfolio of high-quality gold and copper assets in Ecuador.

During the quarter, the company continued its drilling operations at Bramaderos Gold-Copper Project, returning grades and widths in line with, or better than, other porphyry gold-copper deposits.

Results from drill holes BMDD014 – 018 and 022 – 025 were reported during the quarter, delivering significant, consistent gold-copper intervals greater than 300 metres, with higher-grade sub-intervals.

Looking ahead, strong potential exists for the Brama-Alba deposit to extend significantly to adjacent targets Melonal and Playas.

At El Palmar, drilling defined higher copper grade domains at greater than 0.2% copper and 0.35g/t gold.

Furthermore, immense upside remains at El Palmar, with drilling to date limited to the south-eastern portion of the main target area, with the western and northern portions remaining largely untested.

Location of the El Palmar project in northern Ecuador, the Verde Chico project nearby, and the Bramaderos Project in southern Ecuador.

Polarx Ltd (ASX:PXX)

Polarx Ltd has had a busy June quarter, delivering “exceptional” bonanza grade gold hits at its Humboldt Range Project in Nevada.

The results highlight the potential for Star Canyon to host high-grade gold and silver veins within a potentially bulk mineable Carlin-style system in Nevada, a world-class precious metals province.

Drillhole BC22-005 intersected 9.1 metres at 124.36 g/t gold and 48.6 g/t silver from 27.4 metres to 36.6 metres, including, 3 metres at 371g/t gold and 143.5g/t silver.

Notably, the mineralisation remains open and largely untested for the extension of bonanza grade veins.

At Alaska Range Project, the company progressed a scoping study evaluating the combined mining and processing of Caribou Dome and Zackly deposits.

Intensely veined and altered volcanic rocks associated with gold anomalism.