The ASX showed some signs of recovery today, creeping up 0.23% or 16.0 points to 7,050.10 and moving above its 200-day moving average.

Energy and Materials once again led the index higher, gaining 1.40% and 1.34%, while other sectors fell flat or languished in the red. Financials, Healthcare and Real Estate took particularly hard hits, shedding 0.54%, 0.42% and 0.83% respectively.

Commodities were in better shape, with gains for zinc (+1.96%), tin (+1.77%), silver (+0.98%) and gold (+0.80%) while platinum slipped 1.64% and nickel had smaller losses of 0.93%.

West Texas Intermediate also lifted, up 0.95%, although still down 4.24% for the month and 28.90% for the year.

The top-performing stocks on the ASX200 today were Reliance Worldwide Corporation (ASX:RWC), up 5.38%, and Deterra Royalties Ltd, up 5.09%.

Reliance World Corp has been on a tear this month, gaining 20% in its share price.

Analysts say the company’s profit is expected to grow by 13% over the next couple of years, having launched several new plumbing, heating, water and air products in America and rejigged its manufacturing operations in Australia to support demand from Asia-Pacific.

It's less clear why Deterra, a mining royalties company, is making gains - anaylsts are quiet on the stock, and there have been no market-sensitive announcements in the last few weeks.

Inflation and consumer spending falls

The Consumer Price Index fell to just 6.8% this last month, the Australian Bureau of Statistic’s latest report has shown, the lowest rate of inflation since June last year.

Given the market was expecting a CPI of 7.2%, this may be the first real indicator that a rate hike pause is on the cards for the RBA.

"The drop in inflation is a strong and positive sign that the RBA's monetary policy measures are starting to take effect,” Frollo chief customer officer Simon Docherty said.

“This is welcome news for Australian consumers who have been struggling with the rising cost of living over the past year.

“Data from our budgeting app shows that consumers have been allocating an increasing portion of their income towards essential expenses like groceries, healthcare, and insurance.

“Many have also turned to unregulated credit sources such as Buy Now Pay Later (BNPL) providers, with the average BNPL user spending more than $400 per month on repayments.

“As a result, it was only a matter of time before consumers began to reduce their spending and tighten their budgets.

“However, policymakers must balance the need to slow down the economy with the potential impact on consumers and small businesses.

“It's important to ensure that the economic slowdown doesn't have a severe knock-on effect on everyday Australians."

More than half say life is harder than two years ago

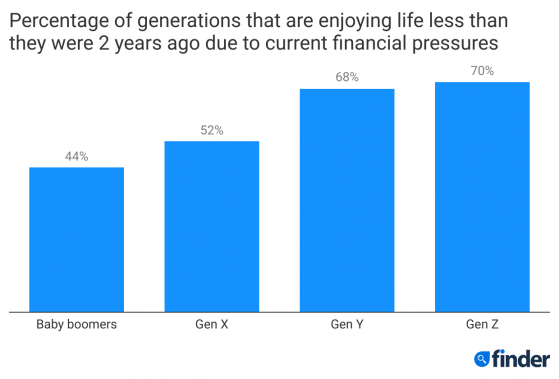

A whopping 59% of Australians said they enjoy life less compared to two years ago in Finder’s latest Cost of Living Report (2023), an unsettling number given we were at the height of a global pandemic two years ago.

Cost of living and inflationary pressures seem to be the main cause, with financial concerns affecting the younger generations disproportionately.

“Aussies are paying a premium for everything from petrol to pasta and the rising costs have sent some into a downward spiral,” Finder money expert Rebecca Pike said.

“The bad news just seems to keep coming for stretched households and there’s less money for finding the right work-life balance.”

Pike has some suggestions for Aussies looking to tighten the belt.

“Decrease daily expenditure as much as possible and get creative with ways to increase income streams.

“During these next 12 months, try to find enjoyment in saving money instead of spending it.

“Make saving money a game by having a ‘no spend month’ or try to see how far you can stretch $100 at the supermarket – this can actually make frugality a bit more fun," Pike said.

Finder also suggests refinancing your mortgage, comparing and shifting your utility bills, and finding high-yield savings accounts to make the most of your existing capital.

The Five at Five

Infinity Lithium soars on grant of key exploration permit at San Jose Lithium Project in Spain

Infinity Lithium Corporation Ltd (ASX:INF) has soared after subsidiary Extremadura New Energies was granted a key exploration permit over the San José Lithium Project in Spain, which the company describes as a “major milestone”.

Read more

Highfield Resources secures final construction licence to proceed with Muga Potash Mine’s process plant; shares soar

The remaining licence for the construction of a process plant for Highfield Resources Ltd (ASX:HFR)’s Muga Potash Mine in Spain has been granted by the local authority, the Townhall of Sangüesa in Navarra.

Read more

Elixir Energy lays groundwork for 'green gas' at Grandis ahead of east coast supply crunch

Elixir Energy Ltd (ASX:EXR) has executed a land access agreement and welcomed strong contractor support for a planned appraisal well at its Grandis Gas Project in Queensland’s Taroom Trough.

Read more

Global Health’s software platforms to support Woolworths Group’s subsidiary HealthyLife

Australian healthcare application provider Global Health Ltd (ASX:GLH) has partnered with Woolworths Group’s subsidiary HealthyLife with its initiative to implement a new telehealth service.

Read more

St George Mining intersects wide, continuous pegmatite intervals as Mt Alexander lithium potential grows

St George Mining Ltd (ASX:SGQ) has unearthed a combined 225 metres of pegmatite intervals in drilling at the Mt Alexander Project in Western Australia, with one continuous 120.8-metre interval unearthed some 631.2 metres downhole.

Read more

On your six

One to watch

Sarytogan Graphite debuts high-quality Kazakh exploration play

Sarytogan Graphite Ltd (ASX:SGA) MD Sean Gregory tells Proactive the company has been granted a licence to explore the Kenesar Graphite Exploration Project in northern Kazakhstan. He says an EM geophysical survey is planned with the highest priority targets scheduled for exploration drilling during the 2023 field season.

Watch more

Read more on Proactive Investors AU