Investing.com - The S&P/ASX 200 benchmark moved up by 0.6% or 43 points to reach 7764.6, with the energy and financial sectors leading the charge.

However, the tech and materials sectors applied a downward pressure on the ASX. Family tracking app Life360 Inc (ASX:360) had to counterbalance earlier losses after confirming an earnings loss guidance between $US8 million ($12 million) and $US13 million ($20 million) for 2024.

In the energy sector, Beach Energy Ltd (ASX:BPT) experienced a noteworthy 4.6% increase. Santos Ltd (ASX:STO) and Woodside Energy Ltd (ASX:WDS) also gained 1.7% and 2% respectively, and Ampol Ltd (ASX:ALD) was up by 1.5%.

In the financial realm, Westpac Banking Corp (ASX:WBC), National Australia Bank Ltd (ASX:NAB), and ANZ Group Holdings Ltd (ASX:ANZ) all rallied by 1.3%, while Commonwealth Bank Of Australia (ASX:CBA) added 0.7%. In contrast, mining giants Rio Tinto Ltd (ASX:RIO) and BHP Group Ltd (ASX:BHP) saw their early gains reversed, with decreases of 0.2% and 0.4%, respectively.

Gold miners had a rewarding day as gold prices rose, sparked by expectations that the Federal Reserve might lower interest rates this year. St Barbara Ltd (ASX:SBM) surged 13.5% following a positive outlook for its Simberi site in Papua New Guinea. Gold Road Resources Ltd (ASX:GOR) rose by nearly 4.8%, and West African Resources Ltd (ASX:WAF) gained 2.7%.

Gain critical insights for your favourite companies with InvestingPro! Unlock access to AI-powered ProPicks, ProTips and more! Use coupon code INVPRODEAL and receive an additional 10% off!

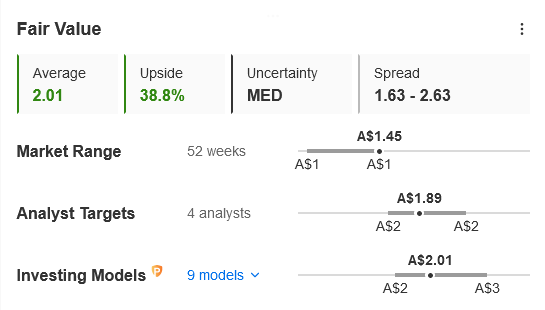

WAF Fair Value indicates a 39% upside! Dive into the data and discover top-value picks with InvestingPro!

On the corporate front, regional lender Suncorp Group Ltd (ASX:SUN) experienced a slight decrease of 0.2% following a report of an $85 million increase in past-due loans in the March quarter. Insurance group QBE managed to rebound, confirming its full-year outlook of mid-single-digit growth in gross written premium, leading to a 0.4% rise in its shares.