Investing.com - Australian stocks are predicted to take a hit, following unsettling labour data from the US that has left Wall Street anxious. The concern stems from the fear that persistent inflation might compel the Federal Reserve to maintain higher interest rates for an extended period.

The alarm was triggered after recent data revealed that US labor costs had surged by 1.2% in the last quarter, exceeding expectations. This marks yet another indication of the ongoing pressure from inflation.

Adding to the unease, two-year Treasury yields have reached over 5%, a peak not seen since November. This development comes as the markets anticipate the Federal Reserve's rate decision on Wednesday (Thursday AEST). The consensus is that the rate will remain unchanged, but there's an expectation of a hawkish stance from Chairman Jerome Powell.

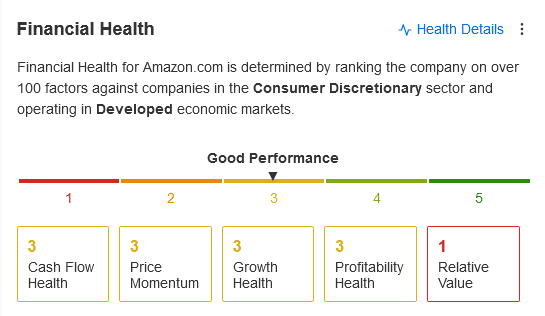

On the tech front, Amazon.com Inc (NASDAQ:AMZN) reported robust sales for its cloud division, driven by an increased demand for artificial intelligence.

Meanwhile, oil prices have dipped to near their lowest in a month, as the potential for a ceasefire in the Middle East has reduced geopolitical tensions. West Texas Intermediate fell below $US82 a barrel, nearing its 50-day moving average of approximately $US81.80.

In company-specific news, Restaurant Brands (ASX:RBD) reported total sales of $NZ333 million ($303 million) for the first quarter of the year. The New Zealand-based company noted that robust sales growth in the New Zealand and Hawaiian markets helped offset slower sales growth in Australia and negative sales growth in California.

Lastly, Woolworths Ltd (ASX:WOW) has confirmed the sale of 5% of Endeavour Group Ltd (ASX:EDV) for $468 million through a block trade for $5.22 per share. After the transaction, Woolworths' stake in Endeavour will stand at 4.1%.