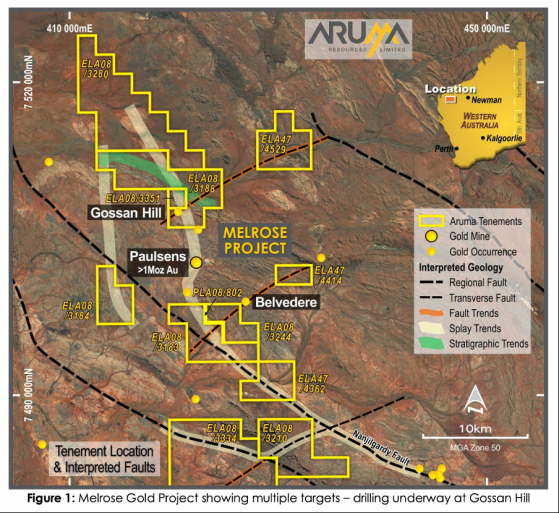

Aruma Resources Ltd (ASX:AAJ) has set the drill bit spinning in its maiden drilling campaign at the Melrose Gold Project in WA’s Pilbara region.

The precious metals explorer has embarked on the first phase of drilling at the Gossan Hill prospect, designed to target broad gold intersections defined in historical drilling.

Interestingly, Aruma’s primary target sits within a strong surface geochemical gold anomaly, which showcases a structural setting similar to the nearby Paulsens Gold Mine (previously owned by Northern Star Resources (ASX:NST).

The company’s 26-hole, 3,000-metre campaign should be complete within a fortnight and Aruma will release its findings as and when they become available.

Chasing up historical grades

Aruma managing director Peter Schwann said of the initial campaign: “The Melrose Project is one of our core exploration focuses and we are excited to have commenced the maiden drilling program at the priority Gossan Hill target.

“The significant, historical gold grades over very wide intercepts at Gossan Hill are consistent with the wide carbonate halo around the richer sulphide cores of these types of deposits.

“This is interpreted to fit exactly with the Aruma exploration model, and the style and host rocks at the rich mineralisation at the nearby Paulsens Project.”

All eyes on Gossan Hill

As it kicks off the maiden program, Aruma will take the magnifying glass to the Gossan Hill Prospect, a target of interest given its proximity to the Paulsens gold camp.

In the past, drilling at Gossan Hill has returned notable, thick gold intersections, such as:

- 27 metres at 0.3 g/t gold from surface;

- 18 metres at 0.26 g/t from 63 metres, including 1-metre at 1.44 g/t from 63 metres; and

- 11 metres at 0.42 g/t from 8 metres, including 1-metre at 2.74 g/t from 14 metres.

As such, Aruma’s drilling will aim to define gold grades and controls on mineralisation and provide a deeper understanding of Gossan Hill’s lithology, mineralisation types, metallurgy and stratigraphy.

The company has a program of work in place that covers 200 reverse circulation holes, but for now, it plans to drill 26 across five lines in an initial program.

Depending on the results, however, this could be extended to 50 holes across 10 drill lines.

Read more on Proactive Investors AU