Arm a bright spot in SoftBank circus

Japanese investment Titan SoftBank Group posted some fairly dire results in today’s 2022 full-year earnings call.

Net losses for the year ending March 31 totalled 970 billion yen (£5.7bn), which in fairness was a 43% year-on-year improvement.

Flagship investment vehicle SoftBank Vision Fund (SVF), the global tech-heavy baby of SoftBank founder Masayoshi Son, logged a crushing investment loss of 4.3 trillion yen (£25.4bn), roughly 40% worse year on year, thanks mainly to the severe downturn in tech stocks throughout 2022.

On the plus side, SoftBank’s ongoing disposal of its Alibaba (NYSE:BABA) holdings contributed to a considerable uptick in its holding company investment segment, which booked around 3.3 trillion yen (£20bn) income, thus helping to shore up losses attributed to SVF.

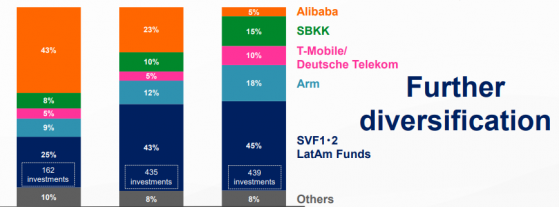

Alibaba, which comprised 43% of SoftBank’s total equity holdings in 2021, now comprises only 5%.

With barely any Alibaba stock left to dispose of, there is little in the way of income to be sourced from SoftBank’s exit of its once premier asset.

Thankfully for SoftBank, Masayoshi’s pivot to the world’s largest semiconductor designer, Britain’s Arm Holdings, appears to be a gamble due to pay off.

In the fiscal year, Arm reported sales of 381.7 billion yen (£2.3bn), reflecting a notable increase of over 27% compared to the previous year.

Arm’s pre-tax income saw substantial growth of 15% year on year, reaching 48.6 billion yen (£288mln).

Softbank’s equity mix has dramatically changed in the past two years, with Arm doubling in size comparative to total holdings in the past 24 months.

SoftBank’s equity mix over two years – Source: SoftBank

Despite still being a relatively small component at 18%, Arm’s pending IPO on Nasdaq is likely to bring in a significant cash injection for SoftBank.

Yet the group has remained tightlipped about the IPO’s progress in recent months, and investors hoping for more news today were unfortunately out of luck.

SoftBank has until the end of September to formally proceed with the IPO to avoid Arm becoming become liable for US$8.5bn of debt taken out against Arm shares under a springing guarantee naming Arm as the guarantor.

Read more on Proactive Investors AU