As the RBA and US Fed kept interest rates on hold last month, the ASX 200 and S&P 500 continue to levitate at record highs. However, the latest US inflation figures show that core CPI rose by 0.4% in March, 0.1% higher than market expectations. The US market was quick to respond, with the S&P 500 falling by almost 1%, writes Msqaured Capital managing director Paul Miron.

A moderate economic slowdown is based on inflation expectations being beaten, but the new US inflation data is a cause of concern for investors.

Recent job vacancy rates were down 6.1% between November 2023 and February 2024 – a fall of 23% from their peak 18 months ago.[1] This signals that demand for labour is in free fall and that unemployment will rise sharply over the coming months. This, in conjunction with weaker retail sales figures, puts in doubt the predictions of a soft landing.

The missed market forecasts for US inflation were not enough to challenge the consensus that our economy will experience a soft landing. With unemployment being at record highs and inflation being stickier than anticipated, it is becoming less likely that rate cuts will come in as expected by the market.

In light of this, 2024 could very well be an incredibly volatile and uncertain year for investors if this critical assumption of a soft landing is proved wrong. As the saying goes “History doesn’t repeat itself, but it often rhymes” - both economists and reserve banks are not known for their track record in forecasting.

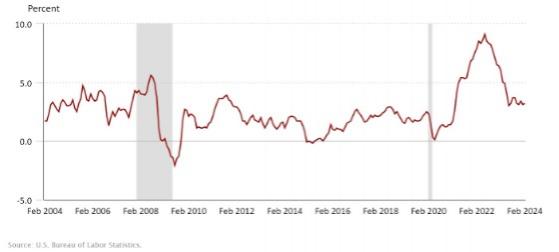

US inflation rate

The core of market exuberance and expectations is centred on the swiftness of global reserve banks cutting official cash rates. Markets anticipate three to four rate cuts in the US. In Australia, it is much the same, with the market widely anticipating that three interest rates cuts will occur in 2024.[2]

Considering the turmoil that could lie ahead, it is an opportune time for investors to pause, reflect and reassess the risk within their portfolio. As is often the case, these thought-provoking times bring to the fore the two golden questions of investing:

Interest rates centre of financial universe

Much like gravity is central to the study of physics, interest rates are the centre of the entire financial ecosystem. A change in interest rates impacts and affects everyone in the economy. It affects the flow and velocity of cash to and from consumers, businesses and the government.

Not to mention, throughout economic history, the world has never avoided a recession during a period of tightening monetary policy. With Japan and the UK already in recession, New Zealand has officially has just joined the club. New Zealand was one of the first countries to tighten monetary policy and its economy is very similar to Australia’s.

We are living through a remarkable economic marvel – employment has remained resilient despite 13 official interest rate increases. This is the main difference to our current economic state and market cycles of the past. This alone inspires optimism.

The natural question that follows is – why would reserve banks globally be in a rush to cut rates? Why not be hawkish and conservative, acting only once we are certain that inflation is behind us, especially with economies showing such resilience?

Higher for longer

The risk of higher interest rates remains elevated, placing a heightened level of risk on most asset classes and simply eroding the cash flow of consumers and businesses.

Australia is already experiencing a per capita recession. While GDP rose by 1.5% over 2023 – with four quarters of rises of 0.6%, 0.5%, 0.3%, and 0.2% – per capita GDP actually fell by 1% in 2023.[1]

This marks a whole year in which households were effectively in a recession, with the economic growth figures cloaking these dire results for households by slowly rising.

Throughout 2023, overall economic growth was entirely due to population growth, specifically immigration.

Higher interest rates are a blunt instrument, indiscriminately impacting young families, mortgage holders and renters, with self-funded retirees mostly unaffected. As much of the COVID-19 savings are being exhausted, there lies the true risk that economic momentum could diminish sharply.

This would increase the risk of rising unemployment and further weakening of consumer sentiment as disposable incomes become stretched. This may just set off a trajectory of deep recession.

Furthermore, inflation has not proven to have found its natural bottom limit as of yet, and it could be bouncing on the wrong side of 3% for longer than anticipated. Again, this would increase the risk of a harder landing than the current market consensus.

The biggest catalyst, other than inflation, keeping interest rates higher for longer, is the strength of Australia’s employment, with the unemployment rate having fallen from 4.1% in January 2024 to 3.7% in February 2024, now being at a 50-year low; this is at odds with the unemployment rate trending to the anticipated 4.5% as per RBA expectations.

The current level of full employment is still placing inflationary pressure on the economy, meaning the RBA will be reluctant to decrease rates until unemployment is closer to the desired 4.5%

How far down will rates go?

We have been fortunate to live through what is often referred to as the ‘Goldilocks’ period of economic prosperity, with interest rates consistently declining over the past few decades … until now. Prosperity has also been abundant due to globalisation, cheap money and geopolitical stability (for the most part).

Economists and reserve bank officials have been actively discussing the concept of a ‘neutral cash rate’, where the official cash rate does not contribute to expanding or contracting the economy. In Australia, the proposed neutral cash rate is around 3.5% as of late.[5]

From a purely mathematical perspective, let’s assume that the official cash rate reaches 3.5% this year. We still don’t know whether this will be enough to quell inflation and whether businesses and households can rebalance after being accustomed to cheap money. At any rate, over a decade of deleveraging is still required for a new normalised interest rate to set in.

Economic cycles

According to Howard Marks, the legendary investor, market cycles are triggered by the collective mood of the market rather than pure economics; that is, market cycles are essentially the product of the collective mood-swinging between optimism and pessimism.

If last week demonstrated that optimism regarding future interest rates is based more on wishful thinking rather than economics, then we are opening ourselves up to the risk of further disappointments.

We already know that market forecasts are often inaccurate, managing inflation is incredibly delicate and complex, and so many variables/possible external events could change expectations instantly. Investors should be factoring in these risks when making their investment decisions.

Rise of alternative investments and private credit

It is no surprise that investors are seeking alternative solutions to the standard 60/40 portfolio. I truly believe we are seeing structural change in the investment market.

We have ‘higher for longer’ interest rates, a green energy transition, less government reliance on income from coal and iron ore, lower productivity, a long-term housing crisis due to lack of supply, and the introduction of AI … just to name a few.

Investors seek investments with downside protection whilst earning a healthy return, often via stable and regular income. This is where private credit is certainly coming into the spotlight. However, investors should be mindful that not all private credit is the same, with different products offering different access and risk profiles.

There is still a lack of awareness of private credit in the Australian market, and once again, the same golden investor questions should be asked: what is the security behind the investment, and how will it perform in black swan events?

When it comes to private credit, the risk all comes down to the quality of security and some very simple rules:

- Look for high-quality borrowers with good track records.

- Make sure prospective borrowers have strong balance sheets and cash flow.

- Clarify and define the exit strategies to the facility.

- What is the quality of security which is underpinning the debt? Is it a liquid asset that can be sold in any type of market conditions?

As always, be careful when lending to businesses during a downturn as there can be less security associated with the loan when the business is not making money. Be wary of illiquid assets, such as farms, land, development, and specialised property, such as pubs, which cannot be easily sold during downturns. Finally, employ disciplined gearing practices as we head into what could be a highly volatile year for financial markets.

Author Paul Miron has over 25 years’ experience in the finance industry and is the principal theorist behind Msquared Capital‘s credit policy. Paul co-founded Msquared Capital after noticing a growing gap in the market for a trusted private credit lender that provides investors with the opportunity to access high-quality mortgage investments backed by quality property along the eastern seaboard.

Msquared is a secured private credit fund, with its flagship Msquared Mortgage Income Fund providing investors with the peace of mind that all debt is backed by high-quality, non-specialised real estate. This fund features NO construction loan exposure, NO rural properties, NO Land and is a pure first mortgage fund. Last month’s return was 7.91% on an annualised basis, with income paid monthly, and a weighted portfolio LVR of 53.32%

If you would like to find out more about the investment products, please feel to contact the office or one of the Investor Relations team at info@msqcapital.com.au.

[1] https://www.abs.gov.au/media-centre/media-releases/job-vacancies-fall-further-february-remain-high#:~:text=There%20were%20364%2C000%20job%20vacancies,November%202023%20and%20February%202024.

[2] MPA: Economists Predict the First RBA Rate Cut

[3] https://www.abs.gov.au/statistics/economy/national-accounts/australian-national-accounts-national-income-expenditure-and-product/latest-release

[4] https://www.afr.com/policy/economy/the-rba-is-betting-against-the-world-on-interest-rates-20231003-p5e9ce

Read more on Proactive Investors AU