Even as banks continue to be trusted pillars of the financial landscape, the pressing question emerges: Are they sufficiently equipped to confront the menace of fraud?

Recent analysis from RFI Global, a reputable insights provider, unveils a growing anxiety among Australians about banking fraud.

Older Australians appear to be especially at risk, with about 63% having encountered communications with scammers who are feigning affiliations with official entities such as mygov.com.au and the ATO.

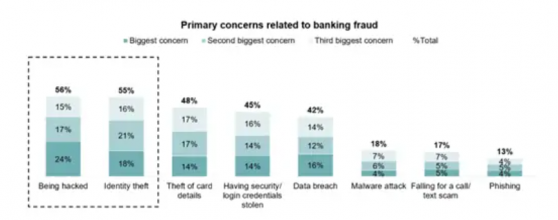

While hacking and identity theft top the list of concerns for most Australians, fears also extend to unauthorised access to card information and the pilfering of essential security and login credentials.

RFI's study reveals that one in five Australians have been victims of banking fraud.

What's more, a recent OAIC survey has also revealed that nearly half of the Australian population are already victims of data breaches - which further complicates the issue.

Primary concerns related to banking fraud.

The balancing act: trust and action

While banks enjoy significant trust capital, maintaining this trust is a delicate operation.

RFI's research draws parallels with the telecommunications sector, whose trustworthiness plummeted after the widely reported data breaches in 2022.

This sketch paints a nuanced picture - while a significant majority of customers endorse their bank’s security infrastructure and rely on their banks for protection, there's a vocal demand for better fraud prevention education.

Digital banking: A blessing and a curse

The ascendance of digital banking is undisputed. The convenience of mobile and online banking has made it the preferred mode of transaction for 75% of Australians.

However, the human touch remains critical, especially in distressing times like after a fraud.

Notably, customers continue to value the role of call centres for support during such adversities.

What customers expect: security and reassurance

RFI’s findings indicate a clear customer mandate: while they demand rigorous security, they also expect a seamless banking journey.

The pinnacle of customer assurance in this space is a categorical pledge of monetary recovery post-fraud.

Thus, while banks have the latitude to fortify their security frameworks, such augmentations need to be harmonised with a user-centric approach.

Read more on Proactive Investors AU