archTIS Ltd, a global provider of data-centric software solutions for the secure collaboration of sensitive information, is one of those businesses that quietly goes about its trade, building its revenues, client base and future foundations.

The company continued in this vein in the fourth quarter of 2024.

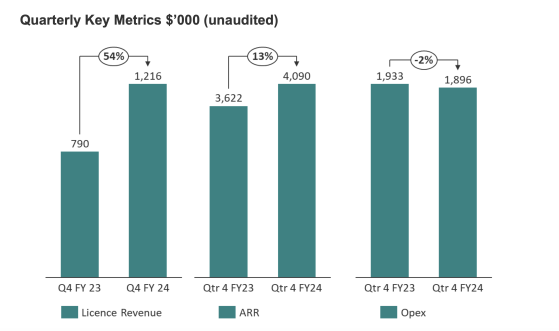

archTIS reported a 54% increase in annual revenue, with licensing revenue rising by A$1.8 million.

Gross margin for the year was 60% or A$5.85 million, up 79% on FY23 while operating expenses decreased by 18%.

Positive operating cash

The company generated positive operating cash of A$1.4 million through record cash receipts, marking a significant improvement from the previous year's outflow.

Overall cash outflows for operating and investing activities was A$1.3 million, an improvement of A$3.9 million from the FY23 cash outflow of (A$5.3 million).

Quarterly revenue was A$1.5 million driven by strong licensing revenue of A$1.2 million, up A$425,000 and 54% on the prior comparative period (PCP).

Services revenue was A$300,000 for the quarter, which was as expected due to the drive to complete the outstanding service contracts in the third quarter of FY24.

Annual Recurring Revenue (ARR) reached A$4.1 million, up 13% from the previous year.

The company finished the financial year with A$3.988 million of available funding.

What has driven this growth?

The company secured new contracts with key clients including the Australian Department of Defence, Penten and various global defence suppliers. Notable deals included a A$264,000 annual recurring revenue licence fee with Penten and a A$775,000 licence renewal with the Australian Department of Defence.

archTIS also retained and expanded its customer base, achieving net revenue growth of 104%.

Additionally, archTIS won two CyberSecurity Excellence Awards and announced Copper River Technologies as a new US Federal partner.

“archTIS has had a productive quarter that will position it well for further growth in FY25,” AR9 managing director and CEO Daniel Lai said.

“We have been disciplined in managing our cash expenditures across the past year, which has been supported by strong revenue growth and increasing margins.

"The most pleasing aspect of the quarter has been the increase in global sales activity driven by the need for defence allies and industry to solve their data-centric security and information sharing needs. I am looking forward to what we can achieve in the new financial year.”

archTIS expands global presence

archTIS landed several new and expanded contracts across various regions. Key in-quarter deals include:

- A licensing agreement with Penten to implement Kojensi for an Australian national security agency, generating an annual recurring revenue licence fee of A$264,000 and implementation services of $202,000.

- A A$775,000 renewal of Kojensi on-premises licence by the Australian Department of Defence.

- KPMG Australian Technologies Solutions (KTech) issued additional work orders worth approximately A$300,000 for data-related architecture consulting services.

- A command and control department within the Australian Department of Defence purchased A$630,000 of services for NC Protect, with further licences pending.

- Additional services to BAE Systems (LON:BAES) Maritime Australia supporting an ongoing project.

- A US-based defence contractor selected NC Protect to secure Microsoft (NASDAQ:MSFT) 365 for compliance purposes.

archTIS maintained a net revenue retention rate of 104% for the financial year, with annual renewals from clients such as the Bank of Finland, DHL and several US-based defence companies.

The company also upsold NC Protect and Kojensi SaaS licences to existing customers, including i-Sprint (Singapore), a US-based materials science company, a South Korean aerospace company and the Australian Department of Defence.

AR9 is engaged in multiple proof of concepts (POCs) in global markets, including NATO, the US Department of Defense and key manufacturers in the defence industrial base in the US and UK, as well as several Swedish municipalities through partner Complior.

In terms of partnership alliances, Copper River Technologies has joined archTIS's Channel Partner Program in the US. Copper River, a Federally Recognized Alaskan Tribal Small Disadvantaged Business, will resell and provide services for NC Protect, particularly to the US Department of Defense.

“As we close out a record-breaking FY24 where we achieved a significant number of milestones, we turn our attention to 2025,” AR9 COO and US president Kurt Mueffelmann said.

“Our focused go-to-market strategy around product innovation, Defence-driven vertical attention and an expanding global distribution strategy have driven strong and near-term pipeline opportunities, increased partnership activity with Microsoft and a customer-centric approach toward product and solution expansion, all fueled by strong industry tailwinds.”

Cybersecurity awards

All the good work AR9 is doing is being recognised by the broader industry and the company’s peers.

archTIS won two awards in the 2024 Cybersecurity Excellence Awards. Kojensi was named the winner in the National Cyber Defense category, while NC Protect won in the Data-centric Security category.

Also in the quarter, Andrew Burns was appointed chief financial officer (CFO) and company co-secretary. Burns became responsible for overseeing the company's financial planning and analysis, accounting and controllership, taxation, audit and compliance, corporate governance and enterprise risk management functions.

Read more on Proactive Investors AU