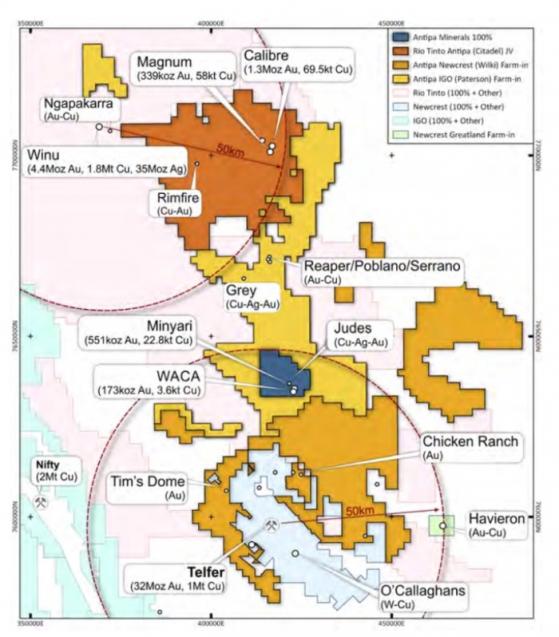

Antipa Minerals Ltd (ASX:AZY) is on the path towards developing its assets in the Paterson Province of Western Australia and has a two-pronged approach - with its joint venture partners and independently on its 100%-owned ground.

The Citadel Joint Venture Project with Rio Tinto Limited (ASX:RIO) (LON:RIO) (OTCMKTS:RTNTF) consists of around 1,300 square kilometres and includes the Calibre resource of 1.3 million ounces of gold and 70,000 tonnes of copper, as well as the Magnum resource with 339,000 ounces of gold and 58,000 tonnes of copper, plus a total combined total of 1.2 million ounces of silver.

Antipa also holds the 100%-owned Minyari-WACA deposits, which hosts a resource of around 750,000 ounces of gold at 2 g/t with 26,000 tonnes of copper.

In addition, the company has two farm-in projects with Newcrest Mining Ltd (ASX:NCM) (TSE:NCM) (FRA:NMA) (OTCMKTS:NCMGY) and IGO Ltd (ASX:IGO) (OTCMKTS:IPGDF) in the province, with both partners undertaking greenfields exploration this year.

“Calibre start-up feed for Winu”

Antipa executive chairman Stephen Power said: “We have got two nearer-term development opportunities and we’ve also got large exploration ground which is being explored with the assistance of (and paid for) by our major joint venture partners.

“The Calibre resource on the Citadel Project, is around 45 kilometres away from Winu, which is Rio’s near-term copper-gold-silver development that they expect to be in production in around 2024.

“Our Calibre resource is two things, it’s higher grade than Winu and it’s also better metallurgically so we think it’s an excellent prospect as a start-up feed opportunity for Winu.

“Notably, Rio upped their 2020 exploration budget from $2 million to $12.6 million which will deliver an upgraded mineral resource but also preliminary metallurgical test-work and possible early-stage development studies for Calibre.”

Power said the company was targeting the mineral resource upgrade for the current quarter or potentially early in the next quarter.

Minyari and WACA deposits

The company is confident that its wholly-owned ground in the province is also a strong development opportunity, consisting of the Minyari and WACA gold-copper-silver deposits.

Power said: “We did further diamond drilling last year and we expect the results this quarter, and we hope that will push that into a development proposition.

“The important thing to note there is that the development opportunity can be either standalone or, if it doesn’t fill its own boots enough to build an ore processing facility, then Newcrest’s Telfer plant is just 40 kilometres down the road - so there may be a toll-treatment opportunity there.

“Telfer is crying out for feed, it’s a 20 million tonnes per annum plant which desperately needs feed, and it could even become a processing hub for the province.”

Antipa holds a strategic land position in WA’s world-class Paterson Province.

High grade and depth of cover

Power said that one key factor for the Minyari-WACA gold-copper project was that the depth of cover was very shallow which made for favourable evaluation and development economics for a company of Antipa’s size.

He said: “We’ve got some of the best ground in the province, with a maximum of 80 metres of cover at Calibre and 10 metres at Minyari-WACA.

“Compare this to other deposits in the region like Havieron, where the gold-copper mineralisation starts at over 430 metres below the surface which needs an expensive decline to be built to get down there.

“Less than 10 metres of free dig cover and gold grade of 2 g/t, means Minyari-WACA does not require huge pre-production mining capital and the scale of a potential mining and processing operation is very much doable by a company the size of Antipa.”

Citadel exploration plans

Assay results received in early February from the final five of the 27 diamond core and reverse circulation (RC) drill holes drilled at the Calibre deposit in the 2020 field season showed further high-grade gold-copper intersections at the Citadel Project.

In addition, recent drilling at the Rimfire area intersected strong gold-copper intersections in four reconnaissance RC holes which tested greenfield magnetic targets.

Looking forward, the Citadel 2021 exploration program will consist of:

- Calibre deposit update to existing Calibre mineral resource;

- Calibre deposit preliminary metallurgical test-work and possible early-stage project development options appraisal studies;

- An 11,000 to14,000 metres drill program focused on the Magnum Dome area, hosting the Calibre, Magnum and Corker deposits and Rimfire area – together with other regional targets including Boxer – planned to begin in March;

- Continuation of gradient array induced polarisation (GAIP) survey program across prospective structural corridors of Citadel tenements; and

- Processing and interpretation of GAIP and drill hole data to identify future priority target areas.

Recent assay results received from aircore drill testing of greenfields geophysical targets at the Minyari Dome Project have added to the development potential of Minyari-WACA, which lies just 3 kilometres away.

The 2021 exploration program for Minyari Dome will most likely consist of the following in combination with brownfield and greenfield exploration activities:

- RC and diamond core drill evaluation of the development potential of the Minyari and WACA deposits;

- Drill evaluation of the Judes copper-silver-gold deposit;

- Aircore and RC drill follow-up of newly identified gold-copper targets;

- GAIP surveys; and

- Systematic, fine fraction, soil sampling program across the highly prospective Minyari Dome Project with the objective to repopulation the exploration (target) pipeline.

Read more on Proactive Investors AU