Investing.com - Investors are eagerly awaiting Tesla's (NASDAQ:TSLA) second-quarter earnings report, with Wall Street analysts particularly interested in updates regarding the firm's Robotaxi and Full Self-Driving (FSD) technology. Tesla's energy business could also be a significant driver for its long-term growth, according to market strategists.

Despite facing a challenging first quarter due to declining EV demand and rising competition in China, Tesla is expected to rebound, with many Wall Street analysts predicting a brighter future for the company.

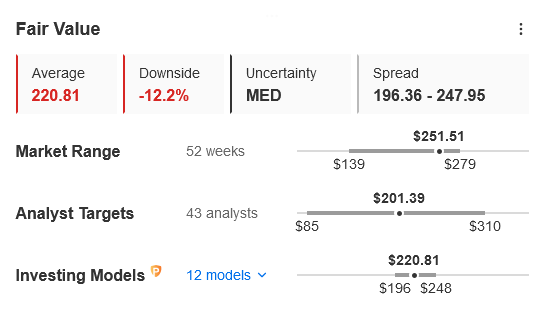

⚠️InvestingPro's Fair Value indicates a 12.2% downside for Tesla - Approach with caution!⚠️

The company's second quarter saw better-than-expected deliveries, and a recent shareholder vote has helped mitigate concerns surrounding CEO Elon Musk's compensation.

The technology sector is eagerly anticipating Tesla's Robotaxi Day in early October, which might reveal more about the company's progress in autonomous vehicle technology.

Market participants are particularly bullish on Tesla's potential in AI, with some suggesting that the company's advancements in this field could lead it towards a $1 trillion valuation.

Wedbush Securities has indicated that Tesla's price cuts are likely to end soon, and EV demand is expected to improve over the next year. CFRA Research analysts, on the other hand, have suggested Tesla's Robotaxi Day might overshadow the actual earnings report, with the EV maker's long-term growth in focus.

Morgan Stanley (NYSE:MS) analysts have highlighted that Tesla's energy business could be a major boost for the company, while artificial intelligence remains key to Tesla's growth story, according to Oppenheimer.

However, Morningstar has suggested that Tesla's valuation is overstretched, advising investors to wait for a larger pullback before investing.