Anson Resources Ltd (ASX:ASN, OTCQB:ANSNF) has completed the geotechnical engineering study at the Paradox Lithium Project in Utah, USA which has confirmed that subsurface conditions are suitable for the construction of foundations for the project’s proposed processing plant.

This engineering study is a key component of the due diligence process undertaken to confirm the suitability for the location of the proposed direct lithium extraction (DLE) processing plant at the Paradox Project.

The study was designed to collect data on the subsurface conditions at the proposed processing plant site to help determine the design and construction of preliminary foundation options.

The body of work under the study consisted of site reconnaissance, subsurface exploration, acquisition of geophysical data and engineering analysis.

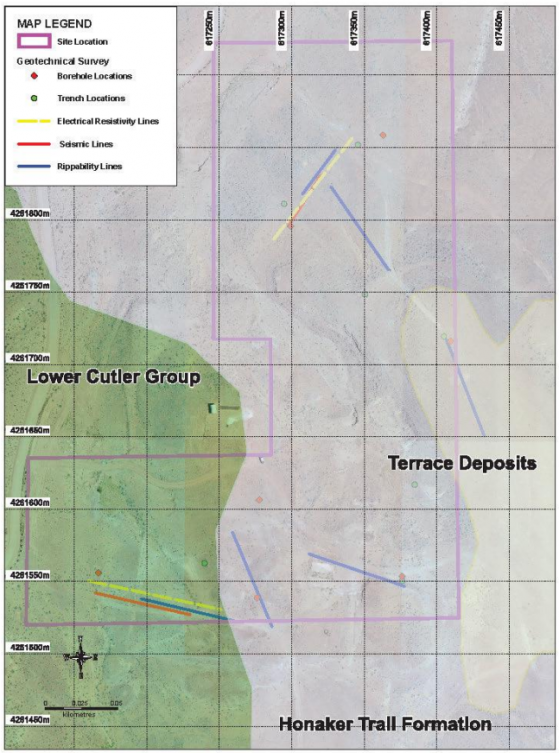

Plan showing boreholes, trenches and geophysical lines in the geotechnical engineering work.

The geotechnical study collected data and subsurface conditions for general construction recommendations and consisted of 7 core holes and 7 trenches:

- Depths of boreholes ranged from 9 to 62.5 feet;

- depths of the trenches ranged from 0.5 to 7 feet.

The study has recommended that prior to the laying of foundations, general site grading be carried out to provide proper support for foundations, exterior concrete flatwork and concrete slabs-on-grade.

Proposed Paradox Lithium Project production site

The proposed site for the Paradox Project processing plant is strategically located adjacent to the Colorado River, ~10 kilometres from the well extraction site and is mostly downhill.

It is situated on around 8.1 hectares (~20 acres) of privately-owned vacant land, near large-scale potash producer Intrepid Potash’s (NYSE: IPI) production facility and evaporation ponds in the district and hosts only sparse vegetation including native grasses and brush at an approximate elevation of around 1,280 metres (4,200 feet).

Plan showing the brine pipeline from the extraction site to the proposed processing plant site.

This proposed site has been selected as it provides access to water from the Colorado River which is essential to the operation of the direct lithium extraction process.

The preferred water extraction point is 600 metres from the production location. A water rights agreement for the project is in place.

Access to the proposed site follows existing pipeline pathways and existing roads, which Anson anticipates may simplify and shorten the timeline for the Right of Way (ROW) approval process.

Read more on Proactive Investors AU