Utah's Department of Natural Resources, Division of Water Rights, has approved an application submitted by Blackstone (NYSE:BX) Minerals NV LLC, a wholly-owned subsidiary of Anson Resources Ltd (ASX:ASN, OTCQB:ANSNF), to appropriate water (brine) for lithium extraction at Green River Lithium Project.

This marks the first permit approval Anson has received from the division for lithium production from brine at the Green River Project.

The permit allows the non-consumptive use of 19 cubic feet per second (0.54 cubic metres per second) of brine for processing through a lithium extraction method before returning it to the geological formation from which it was extracted. Since all the brine will be returned to its source, the division has classified its use as non-consumptive.

Additionally, the division notes that the company has submitted an Underground Injection Control (UIC) Technical Report for a 'UIC Class 5 Spent Brine Return' Well to the Utah Division of Water Quality, which is currently under review.

“This approval is significant as it is the first granted to the company by the State of Utah for the processing of brine for lithium extraction at Green River," Anson’s executive chairman and CEO Bruce Richardson said.

"The company is moving quickly through the government permitting application process which is aided by the acquisition of private land at Green River.”

Metres from lithium extraction plant

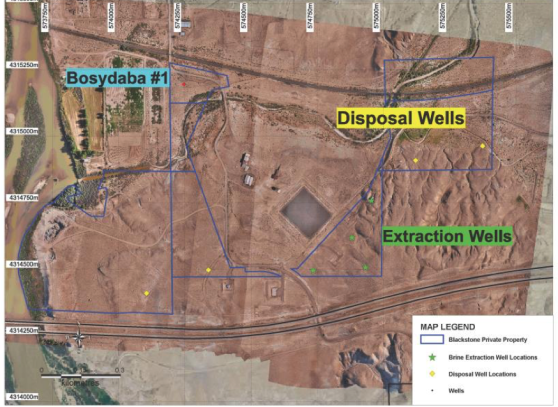

The four planned extraction wells will be on private land, which the company acquired in September last year. These extraction sites are just metres from the proposed lithium extraction plant.

Map showing Green River Lithium Project proposed extraction and disposal wells.

“The planned extraction wells are to be located on that land, a brownfields site where there has already been surface disturbance,” Richardson said.

“Importantly, the Department of Natural Resources acknowledged that there was no connection between the brine that Anson intends to extract and surface waters including rivers and groundwater systems and that the process that the company has determined to use to extract lithium and return the waste brine to the Paradox Formation is a non-consumptive process, unlike evaporation ponds.

“This process has less impact upon the environment, one of our key objectives.

"The Green River Lithium Project continues to develop at a rapid pace with the recent completion of the Boysdaba #1 well and the commissioning of the Sample Demonstration Plant.

"The company will continue to push forward with the development of the Green River Lithium Project to deliver increased shareholder value.”

No hurdles

The division further determined that the water was unappropriated and there were no existing water rights for the extraction of brine at this source.

Additionally, it was established that withdrawing brine water from the depth specified would not impair existing rights, interfere with more beneficial water uses or negatively impact the water supply.

Anson has already secured all necessary federal government approvals for lithium production at Green River and is making significant progress with several permit applications in the State of Utah.

Read more on Proactive Investors AU