Anson Resources Ltd (ASX:ASN, OTCQB:ANSNF) has fielded strong assay results from the supersaturated brines at its Green River Lithium Project in Utah, USA.

The exploration program was designed to confirm the presence of lithium-rich brines and deliver a maiden lithium JORC mineral resource at Green River.

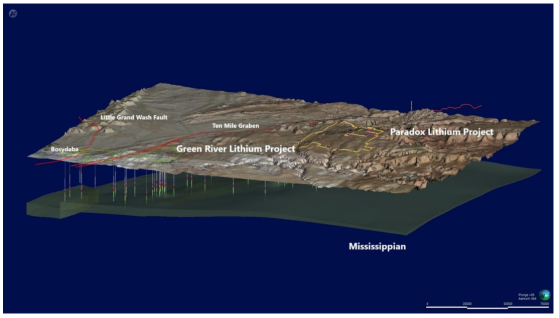

It has, in fact, also served to prove that the regional geology at Green River is comparable or superior to that of Anson’s flagship Paradox Lithium Project, 50 kilometres southwest of the project, in south-eastern Utah, USA.

Elevated lithium content

The findings revealed elevated lithium content, reaching up to 236 parts per million (ppm) with an average grade of 171 parts per million (ppm).

The average lithium value is 23% higher than the original samples assayed and is 23% higher than the assay used as the maximum value in the lithium grade range in the initial exploration target estimate for Green River.

The 790-foot thickness of the Mississippian Units is 95% higher than was provided for by previous exploration target estimate, and the bulk samples demonstrate higher lithium grades than those found at Paradox.

The 3D geological model showing a comparison of the thickness of the Mississippian Units at both lithium projects.

Easier access

What’s more, the lower salt concentrations at Green River are expected to benefit the proposed lithium extraction process.

Iron, magnesium, calcium, potassium and boron particles are also significantly lower, which is also beneficial in the direct lithium extraction (DLE) processes.

Testing was undertaken while collecting bulk brine samples for processing in the Koch Technology Services DLE pilot unit and the sample demonstration plant from the recently completed Bosydaba#1 well, 200 metres away.

The Bosydaba#1 well has been left open to allow the extraction of additional brine for ongoing processing.

Anson’s research, based on drilling logs and other data, indicates that the geological characteristics of the Green River project area have a greater thickness of brine-bearing rock units, higher porosity and permeability, and higher recorded pressure in the Mississippian Units.

This results in brine flowing almost to the surface in the drill holes completed. The project also looks to benefit from high pressure, increased porosity and increased permeability.

These key indicators, which the company was able to confirm by drilling Bosydaba#1, suggest that the overall regional geology at its Green River Lithium Project is equal to or better than at Anson’s core asset, the Paradox Lithium Project.

Read more on Proactive Investors AU