Anson Resources Ltd (ASX:ASN) has set the wheels in motion to prove up a mineral resource at the Green River Lithium Project, an exploration target 50 kilometres northwest of its flagship Paradox Lithium Project in Utah, USA.

The company plans a drilling program to re-enter the Mt Fuel-Skyine Geyser 1-25 well to sample the thick Mississippian units and the Pennsylvanian clastic horizons to confirm the supersaturated brines are lithium-rich.

This well pad was previously drilled to a total depth of 9,508 feet and was recorded to contain supersaturated brines.

Plans submitted

To that end, Anson has submitted a plan of operation to the USA Department of the Interior, Bureau of Land Management (BLM) and a notice of intent (NOI) to the Utah Division of Oil, Gas and Mining (UDOGM), Minerals Division.

An application permit to drill (APD) was also submitted to UDOGM due to the depths of the wells.

The exploration program will have minimal new ground disturbance as the existing drill pad needs only to be reinstated.

Anson’s use of existing areas is part of its aim to develop a sustainable project by minimising the impact on environmental, social and recreational activities.

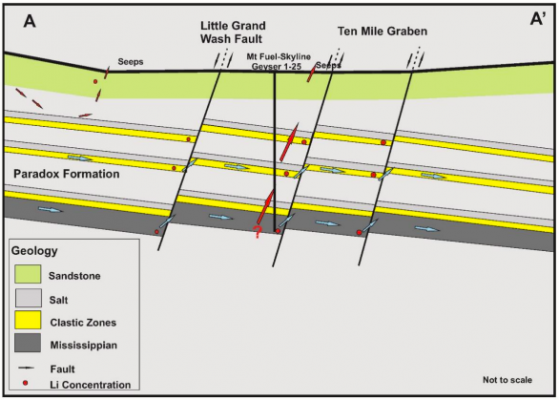

A conceptual model for the lithium exploration program at Green River.

Large exploration target

The Mt Fuel-Skyine Geyser 1-25 well is located east of Green River, along plateaus surrounded by canyons and ridges.

The targeted clastic zones and the Mississippian units have no recorded historical lithium and bromine assays but supersaturated brines have been intercepted during historical oil and gas drilling.

Due to this, the Green River Lithium Project is classified as an exploration target based on data generated from previous drilling programs for oil and gas, drill results from Anson’s exploration programs as well as parameters from Paradox’s JORC resource.

Green River has a conceptual target of 2.0 billion tonnes to 2.6 billion tonnes of brine, grading 100-150 parts per million (ppm) lithium and 2,000-3,000 ppm bromine, which Anson hopes to convert into indicated and inferred resources.