Anson Resources Ltd (ASX:ASN) has finished a Numerical Groundwater Flow Model covering the Paradox and Green River lithium projects in south-eastern Utah, USA.

Anson is focused on developing the Paradox Project into a significant lithium-producing operation. Its goal is to create value through the discovery, acquisition and development of natural resources that meet the demand of tomorrow’s new energy and technology markets.

The flow model, completed by a third party, is to also be used to facilitate project planning, permitting, operations and resource estimation.

Digital simulations confirm the regional flow parameters, while the flow model will be used to convert the indicated resources into reserves, noting that reserve calculations are required for project funding.

“One of the most frequent questions that we are asked about the Paradox Lithium Project is when it is expected that the pressure will drop and to what level. A drop in pressure often occurs in oil projects where reservoirs are usually in pods,” Anson executive chairman and CEO Bruce Richardson said.

“The brine reservoir at Paradox has been discovered by historic drilling programs to cover an extensive area both in the Paradox Formation clastic zones and the Mississippian within the Leadville Formation.

“The 3D modelling that we have done using the data from these drilling programs confirms that the pressure of the brine as it is extracted remains constant providing a continuous feed without the need for pumping.

"Similar to a geothermal project, this naturally occurring energy source provides a feed to the production plant at no extra cost and also can be used to power the extraction process. This is a unique project and Anson is working to maximise the opportunity presented to further lower production costs.”

Benefits of the flow model

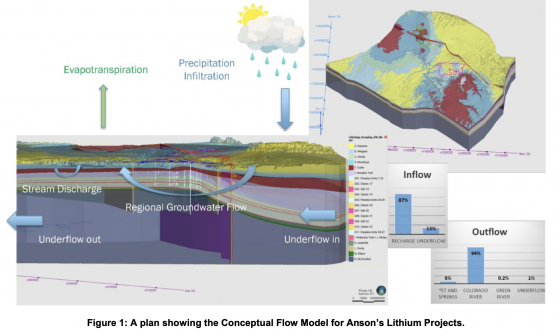

Anson imported the 3D Geological model directly into the flow modelling software to create the conceptual flow model.

Completed initial digital simulations confirm the known flow parameters for the project area, while simulations of lithium-rich brine extracted from the Skyline Unit 1 and Long Canyon Unit 2 wells over a 5-year period show that the pressure remains constant after a minimal drop when artesian flow begins.

The model shows that the constant high pressure over the five-year period will result in the continuation of the artesian flow seen in the re-entry drill programs.

Anson is set to utilise the flow model to ascertain aquifer attributes and flow rates, a significant step where direct measurements are not feasible. The model's capabilities extend to the simulation of aquifer responses under hypothetical conditions, such as determining the flow rates required throughout the project's lifespan to align with future production volumes.

The model is designed to promote more accurate project planning, permitting, operations and reserve estimations, by allowing further sensitivity analysis and predictive simulations.

Crucially, this flow model will equip independent consultants with digital results known as 'Modifying Factors'. These factors are critical in the conversion process of the JORC indicated resources into reserves, a necessary procedure for securing future funding for the project's construction.

Model versatility

In terms of funding sources, Anson is exploring options including Department of Energy (DOE) grants, bank loans and institutional funding. The company is in the process of submitting its DOE application and is in active discussions with various global banks.

The flow model software has been developed to simulate an array of groundwater flow conditions, including evapotranspiration, recharge, drainage and river interactions, to name a few. Its finite difference approach offers the ability to calculate the flow regime with a high level of precision over the water budget discrepancy.

The sophisticated groundwater model leverages cutting-edge computer programming to tackle complex problems involving recharge, discharge, wells, drawdown, and groundwater-surface-water interactions.

For initial calibration and accuracy verification of the flow model, Anson used data gathered from its exploration programs, such as pump testing, along with historical oil and gas drilling information. The company also gathered water data for the region from USGS sources and various research reports.

Beyond merely generating historical, current, or natural stream flow records, the hydrological model can also forecast future yields or carry out scenario modelling. This ability to generate long-term stream flow estimates and trends underscores the model's versatility and its crucial role in the project.

Read more on Proactive Investors AU