Anson Resources Ltd (ASX:ASN, OTCQB:ANSNF) has launched a share placement plan (SPP) to raise $2 million after receiving commitments to raise $5 million via a placement to institutional and sophisticated investors, validating the company’s strategy to accelerate the development of the Green River Lithium Project in south-eastern Utah, USA.

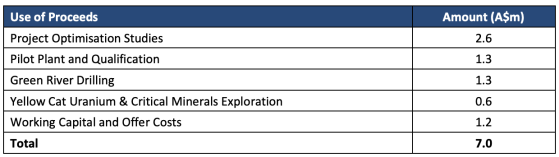

The proceeds will be used primarily to fund project optimisation and engineering work at the Green River Lithium Project. The workstream includes production of bulk samples of battery grade lithium carbonate from the sample demonstration plant for qualification by offtakers and additional resource drilling.

The Green River Project is forecast to underpin low-cost battery grade lithium production that would be profitable under current depressed lithium market conditions.

The project boasts significant infrastructure advantages and is in an advanced stage of permitting, and pilot test work by Koch Technology Solutions is ongoing to support process optimisation.

Funds will also be applied for exploration at the company’s Yellow Cat Uranium Project in the USA and critical minerals exploration in Australia.

Anson executive chairman Bruce Richardson said: “We are delighted by the support for the placement in the current lithium market environment, demonstrating investor appetite for progressing the Green River development strategy.

“We welcome new shareholders who have realised the potential of “US Made” lithium and appreciate how advanced our Green River Project really is in this context.

“The funds raised will allow Anson to continue to optimise the Green River Project, produce bulk samples for qualification by offtakers and expand our lithium Resource.”

Share purchase plan

Anson expects the SPP to be open to all shareholders as at 5:00pm (AWST) on the record date of Thursday, September 19, whose registered address is in Australia or New Zealand.

The SPP will raise up to an additional $2 million in proceeds, with the company retaining the ability to accept applications in excess of $2 million, or to scale back the number of shares issued under the SPP.

Eligible holders will be invited to invest up to $30,000 per shareholder, subject to any scale back. The SPP is not underwritten. Eligibleh Holders will be invited to invest up to $30,000 per shareholder, subject to any scale back.

Under the SPP, Anson shares will be offered at the same issue price as the placement of $0.08 per share.

Read more on Proactive Investors AU