Anson Resources Ltd (ASX:ASN) has wrapped up resource definition drilling at Cane Creek 32-1 well at the Paradox Lithium Project in Utah, USA, with initial assay results confirming the project’s resource expansion potential.

Drilling at Cane Creek successfully targeted additional Clastic Zones 43, 45, 47, 49 and 51, and the Mississippian units around 500 metres below the clastic zones.

The encouraging results have seen ASN securities hit a new record of A$0.465, 10.72% higher than yesterday's close.

Lithium-rich supersaturated brines

The program confirmed that the majority of the clastic zones contain lithium-rich supersaturated brines, providing numerous targets when further drilling programs commence and, of course, significant resource upside potential.

The first assay result was from Clastic Zone 43, which has a thickness of 29.6 metres and returned 108 parts per million lithium.

This is 40% higher than the average grade of Clastic Zones 17, 19, 29 and 33 included in Anson’s recently reported upgraded JORC resource at the Paradox Project.

Assay results from the remaining clastic zones and Mississippian units at Cane Creek are pending.

Also of note is that a number of these additional clastic zones are much thicker than the zones previously sampled and used in the recent JORC resource upgrade.

The extra thickness in the new clastic zones has the potential to deliver a large increase in a further planned mineral resource upgrade, which will incorporate results from the Cane Creek drilling.

Assay data and samples collected from these horizons will provide additional geological information on the brine horizons in the project area which can be sampled in future exploration programs.

The supersaturated brine samples from the drilled zone were sent to SGS North America (Oil, Gas and Chemical Division) in Texas, which has dealt with all Anson’s previous drill samples from Paradox.

Massive brine aquifer

This massive brine aquifer in the Mississippian Units has a thickness between 70 metres to 170 metres and is around 500 metres below the clastic zones.

The exploration program at the Cane Creek 32-1 well did not drill completely through the Mississippian units and when the company wound up the drilling program it was still open at 121.3 metres.

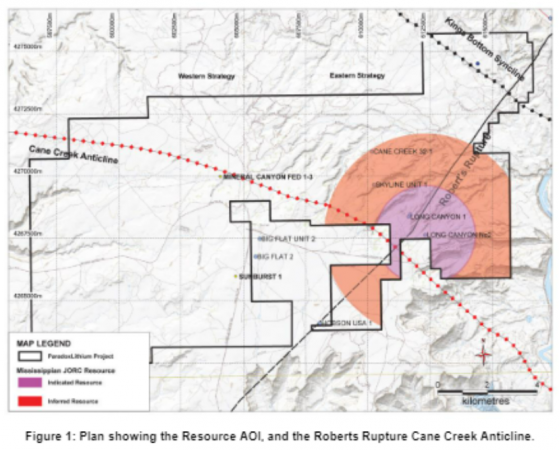

Assay results from both the Long Canyon Unit 2 and the Cane Creek 32-1 wells may indicate a connectivity between the Mississippian and Paradox Formation Clastic zones, due to a geological feature, Robert’s Rupture, which has resulted in the Mississippian rocks being faulted against the Paradox salt beds.

These geological structures have caused higher pressures and porosity in the project area resulting in artesian flow to occur, which means the company may not need to resort to mechanised pumping to extract the lithium-rich brine.

In addition to these wells, numerous other wells that abut the project area have been drilled into or through this limestone unit, including Big Flat 1, 2 and 3.

Read more on Proactive Investors AU