Anson Resources Ltd (ASX:ASN) has acquired a strategic land package of privately owned, industrial-use land for US$2.4 million at Green River Lithium Project in the Paradox Basin in south-eastern Utah, USA.

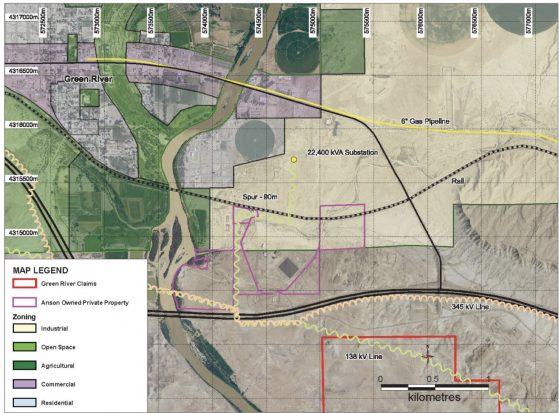

The land package gives Anson ground by existing infrastructure including the national rail network, interstate road system and gas and power, which the company believes could provide major time and cost savings for future project development.

It is also in close proximity to the town of Green River, providing ready access to other supporting infrastructure and potential workforce.

The ground will play a significant role in Anson’s development plans, with the company looking to build its proposed future lithium extraction and production facility at this site.

Emery County zoning of purchased land, proximity of utilities, infrastructure & north end of the Green River claims.

Anson aims to transform the Green River Project into a major lithium production facility, concurrently advancing the adjacent Paradox Lithium Project. Initial design and engineering evaluations concerning plant location and essential utilities such as power and water supply are in progress.

The company has already filed applications to secure the requisite licences for plant development.

“We are excited about the potential to develop a lithium extraction and processing plant at the newly acquired site at Green River,” Anson Resources chairman and CEO Bruce Richardson said.

“Private, industrial-use land is difficult to secure in eastern Utah, as the approval process for privately-owned land is significantly less onerous. We consider the existing infrastructure that surrounds this area to be world-class, potentially reducing the work and costs required to develop the project into production.

“In addition, we have received strong government support for the development of the Green River Project from all levels of government including the local State representative, County representatives and Green River Council representative.

“Anson has already commenced early-stage design and engineering studies, and is evaluating initial financial forecasts generated by these studies, which will be released to the market when they have been finalised. We look forward to providing further details of our ongoing work at the Green River Project over the coming weeks.”

About the acquisition

In the previous quarter, Anson entered into a Letter of Intent (LOI) with US-based, family-owned Boysdaba Holdings LLC for the strategic acquisition of 56.8 hectares of land at the Green River Project.

The company now confirms that all conditions stipulated in the LOI have been fulfilled. A payment of US$2.4 million has been made to Boysdaba, effectively transferring the property title to Anson. This transaction has been officially recorded by both Grand and Emery counties for the respective land parcels.

The acquired land, divided into two lots, includes parcels 06-022-0063 and 05-0022-0052 in Grand County and parcels 01-0156-005, 01-0156-0004, 01-0156-0007 and 01-153C-0004 in Emery County.

The privately owned, industrial-use land acquired by Anson at Green River - showing the six individual land parcels.

The agreement also encompasses water rights, supplementing those already secured, and allows for water extraction from either the Colorado or Green Rivers.

The newly acquired territory is less than one kilometre from the Green River Lithium Project claims area, which consists of 1,265 Bureau of Land Management (BLM) placer claims over an area of 106.2 square kilometres.

Ongoing engineering and regulatory efforts

Design and engineering assessments are underway for the newly acquired land. Initiatives include an electrical engineering study and a geotechnical drilling program tailored for foundational building considerations, potable water supply and the engineering design for water extraction from the adjacent Green River.

Anson is also preparing additional applications, including a Conditional Use Permit (CUP) aimed at infrastructure development and the construction of the processing plant. Efforts have begun on formulating applications for other essential licences. Completion and market announcements concerning these licences are forthcoming.

Plans for Green River

Anson plans to explore and develop Green River in parallel with the development of the nearby Paradox Lithium Project.

The acquisition of Green River is significant in that it not only increases Anson’s US lithium asset portfolio but allows the company to leverage its expertise in the region to fast-track exploration and mineral delineation of the project.

This will be followed by planned project development.

Anson has confirmed an Exploration Target (NYSE:TGT) of; 2.0 billion to 2.6 billion tonnes of brine, grading 100-150ppm lithium and 2,000–3,000ppm bromine at the Green River Project..

Applications have been lodged with the Bureau of Land Management (BLM) for the re-entry of three wells in a JORC mineral resource drilling program at the Green River Project area.

Note: The Exploration Target figure is conceptual in nature as there has been insufficient exploration undertaken on the Project to define a mineral resource for the Leadville Formation. It is uncertain that future exploration will result in a mineral resource.

Read more on Proactive Investors AU