Anson Resources Ltd (ASX:ASN, OTCQB:ANSNF) has new terrain to explore at its Green River Lithium Project in the Paradox Basin in Utah, USA.

Expansion of project

Through its wholly owned subsidiary Blackstone (NYSE:BX) Minerals NV LLC, the company has secured 21 additional strategic blocks to add to the project, spanning 6,685 acres, or 27.05 square kilometres, of lithium-prospective terrain.

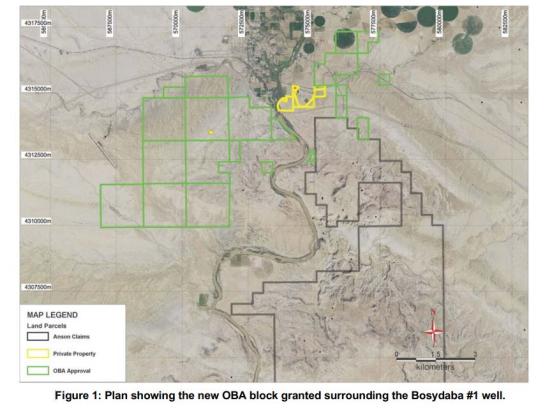

The new blocks were granted under a single other business agreement (OBA) by the Utah School and Institutional Trust Land Administration (SITLA).

The new tenure adjoins Anson’s existing claims and privately owned land, increasing the company's area of influence (AOI) around the recently drilled Bosydaba #1 well, known for its lithium-rich brine intersections.

The blocks are within an 8-kilometre radius of the well, enhancing the exploration potential for future JORC-compliant resource estimations.

Resource volume to grow

The Bosydaba #1 well has intersected Mississippian units more than 790 feet thick, which Anson expects to substantially contribute to the potential resource volume when factored in.

Current exploration targets for the Green River Project, derived from drilling data and previous JORC estimates, suggest a brine resource ranging from 1.1 to 1.6 billion tonnes with lithium grades between 100-150 parts per million (ppm).

Anson’s exploration strategy draws on geological similarities between the Green River and its Paradox Lithium Project, which hosts favourable attributes such as high pressure, increased porosity and permeability.

The company aims to capitalise on these geological advantages to minimise extraction costs and enhance environmental, social and governance (ESG) outcomes.

This strategic land expansion is expected to advance the development of the Green River Project, with the company focusing on future resource upgrades and exploration in the newly acquired blocks.

Support from the government

OBA grant executive chair and CEO Bruce Richardson said: “The decision to grant the 27.05 square kilometres of mineral salt rights around the company’s privately owned land for the extraction brine to produce lithium by the Government of Utah further demonstrates its support for the Green River Lithium Project.

“In recent weeks we have seen the grant of the underground injection control (UIC) permit and the confirmation of the water (brine) extraction permit for the project as well as support earlier this year for the drilling program at Bosydaba#1 well.

“The Green River Lithium Project is progressing at an exceptional rate towards production.”

Read more on Proactive Investors AU