American Rare Earths Ltd (ASX:ARR) (FRA:1BHA) is gearing up for a productive June quarter, having recently completed drilling at its La Paz Scandium and Rare Earths Project in Arizona, in the US.

Nine core holes were drilled ranging from 68 metres to as deep as 122 metres and the company has detected encouraging geology up to four times deeper than the resource depth of 30 metres.

Notably, the original La Paz resource estimate used a cut-off grade of 300 parts per million (ppm) total rare earth elements (TREE) and the drilling campaign has indicated that there is potential to increase the grade and resource size.

Metallurgical test work pending

The drilling campaign produced about 4,500 kilograms of samples from 682 metres of core, which was transported from the site to an assay lab in Sparks, Nevada.

The test work will primarily focus on the use of proven, economically viable processing that is pivotal for the preparation of a preliminary economic assessment that the company expects to publish later in 2021.

The company will seek higher grades of the premium valued scandium, REE magnet metals and heavy REEs, which were identified in the surface sampling program averaging 552 parts per million REEs over the original resources.

Core drill results for La Paz are expected to be announced by the end of this month.

Potential second resource area

Notably, samples collected outside the resource area could point to the potential of the ore body to extend several kilometres to an area of alluvial cover over its centre, as indicated by the strong surface sample results similar to those in the resource area.

The pattern may alternatively represent a potential separate second resource area.

Drilling in areas southwest of the resource will assist to better understand which, if either, of these possible opportunities, may exist.

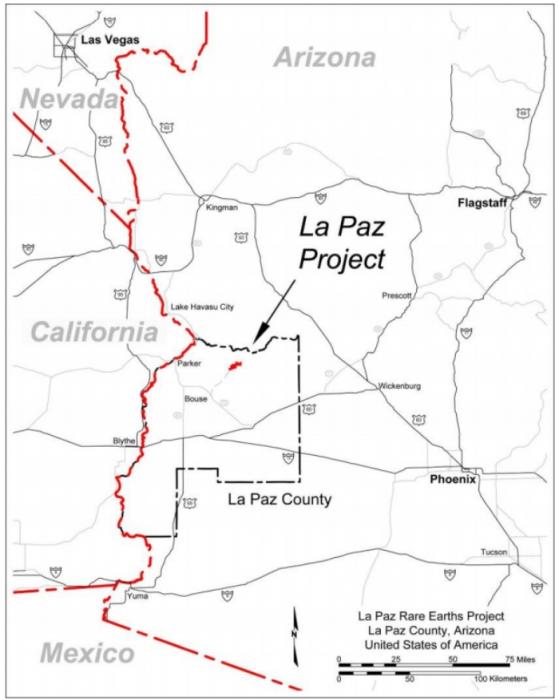

Location of La Paz Rare Earths Project in Arizona USA.

Maiden scandium resource

The drill core results will also be used by the company to determine if a maiden Scandium resource can be established, concomitant and in addition to the Rare Earths resource of 128.2 million tonnes.

ARR expects to be able to upgrade the Rare Earths resource and separately establish a maiden resource for scandium.

The development of a scandium resource in the US is especially attractive to the company for several reasons:

- The US Geological Survey’s 2021 Mineral Commodity Summaries publication states that “Domestically, scandium was neither mined nor recovered from process streams or mine tailings in 2020. Limited capacity to produce ingot and distilled scandium metal existed at facilities in Ames, IA; Tolleson, AZ” and the La Paz project is only 200 kilometres from Tolleson; and

- The US Government identified Scandium along with Rare Earths on its Final List of Critical

A mine of national significance

The company is confident that the La Paz Project is a low-grade, critical mineral target with the extraordinary advantage of its sheer volume, and possible opportunity for:

- Simple concentration via magnetics;

- Ultra-low penalty element content (Thorium

- Low cost of open-pit production.

Additional benefits include the Project’s close proximity to world-class infrastructure within a mining-friendly jurisdiction and the potential job creation opportunities associated with the mine.

The large-scale support of the La Paz Project, not only at the national level through the Biden Administration executive order, but also at the local level within the State of Arizona, gives the company further validation that the La Paz Project sits within a mining-friendly jurisdiction, and provides immense confidence in the potential of the Project to become a mine of national significance.

Read more on Proactive Investors AU