Alto Metals Ltd (ASX:AME) has secured an option to acquire the Lightning prospect which sits immediately west of its Vanguard prospect at its Sandstone Gold Project in Western Australia.

This acquisition would complement Alto’s growth strategy of focusing on near-term growth opportunities within the Alpha Domain, while also testing priority high-grade regional gold targets.

Alto has entered into a binding option agreement to acquire the Lightning prospect (granted mining lease M57/659) within the company’s exploration licence E57/1033 at Sandstone — from a private vendor.

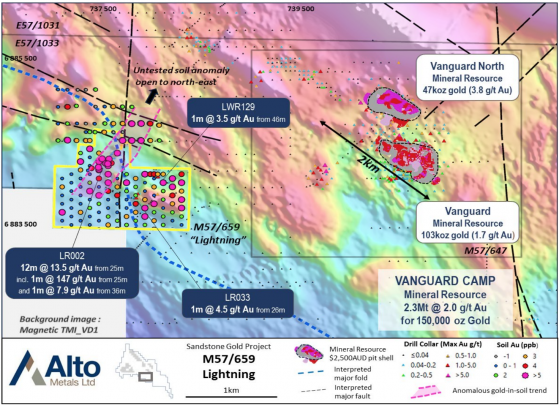

The prospect is 3 kilometres west of granted mining lease M57/647, which hosts the Vanguard gold deposit (2.3 million tonnes for 150,000 ounces at 2.0 g/t gold).

“Great addition to our asset base”

Alto managing director and CEO Matthew Bowles said: “We are pleased to have secured an option to acquire the Lightning prospect, situated within a granted mining lease and immediately west of our Vanguard deposit.

“Limited shallow RAB drilling in the area has returned some significant gold intercepts of up to 147 g/t gold, yet the area has not been tested with deeper RC drilling. There are extensive shallow alluvial gold workings throughout the Lightning area, however, the primary source of mineralisation has not yet been identified.

“With a growing, open-pit gold resource of 832,000 ounces gold at 1.5 g/t, constrained within A$2,500/oz pit shells, at our Sandstone Gold Project, we consider Lightning to be a great addition to our asset base and has the potential to deliver further resource growth in the Vanguard/Lightning area.”

The mining lease has had no RC drilling and remains untested at depth, however, shallow high-grade gold mineralisation has been intercepted in limited historical RAB drilling including:

- 12 metres at 13.5 g/t gold from 25 metres including 1 metre at 147 g/t from 25 metres and 1 metre at 7.9 g/t from 36 metres;

- 6 metres at 1.2 g/t from 26 metres, including 1 metre at 4.5 g/t from 26 metres; and

- 5 metres at 1.2 g/t from 42 metres, including 1 metre at 3.5 g/t from 46 metres.

To the north of the mining lease, a 1-kilometre-long gold-in-soil anomaly (peak 242ppb) on a favourable structural setting has been defined which extends into (E57/1033). This gold anomaly remains open and untested by drilling.

Location of M57/659 Lightning, Sandstone Gold Project.

Work continues

Extensive shallow alluvial gold workings have been undertaken over the Lightning area, however, the primary source of mineralisation has not yet been identified.

The area is structurally complex with folded banded iron formations which are often well exposed. These interflow sediments may represent the mafic/ultramafic contact zone.

Alto continues to compile and validate the historical data over the mining lease and surrounding Lightning area. This work will support targeting work, in preparation for further exploration activities, including additional geochemical sampling and follow-up drilling.

The company also advises that first-pass aircore drilling at the Sandstone North gold target has been completed, with 94 holes and 3,223 metres drilled. The first batch of samples has been prepared and sent to the laboratory for assay.