Altech Batteries Ltd (ASX:ATC) is raising up to A$15.8 million, including A$3 million through a placement to sophisticated and professional investors and up to A$12.8 million via a pro-rata entitlement offer to existing eligible shareholders.

Notably, the proposed entitlement offer will be partially underwritten to the tune of A$6.7 million by Altech’s largest shareholders, Deutsche Balaton Aktiengesellschaft and Delphi Unternehmensberatung Aktiengesellschaft.

The funds raised will be used for the following:

- CERENERGY® project definitive feasibility study, fabrication of two 60kWh battery prototypes and Fraunhofer joint venture payments.

- Finalise construction and commissioning of the Silumina AnodesTM pilot plant and the definitive feasibility study for this project.

- Corporate costs and working capital.

“Having the support of these German shareholders is very pleasing. The capital raising has come at an exciting time for Altech, as we progress with the commercialisation of the 100MWh CERENERGY® battery project, as well as near completion of our Silumina AnodesTM pilot plant.”

About the raise

Altech will issue up to 226,560,014 fully paid ordinary shares at an issue price of A$0.07 per share.

The capital raising comprises:

- a single tranche placement of 42,857,142 shares to sophisticated and professional investors at an issue price of $0.07 per share to raise $3 million; and

- a proposed partially underwritten non-renounceable entitlement offer of 1 share for every 8 shares held by eligible shareholders at the same issue price as the placement of $0.07, to raise up to approximately $12.8 million.

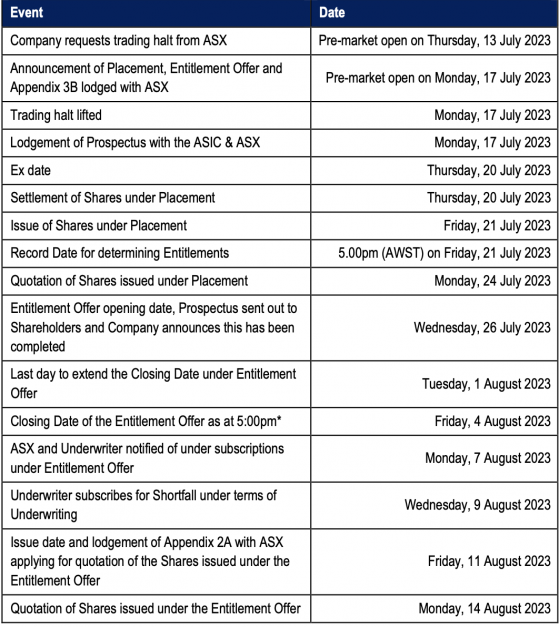

Key dates below:

Read more on Proactive Investors AU